Every freelancer’s least favourite part of running their own business. You’ve pitched, landed the job, delivered your work…and now it’s time to get your money.

That’s exactly what we’re going to share with you in this post: how to invoice your clients for the work you do and how you can accept their payments with ease. Grab your business hat and let’s jump into it!

Who are you dealing with?

The primary point of contact in your client’s office most likely won’t be involved with their company finances in any way, and will simply forward your invoice through to their accounts department when you send it. This means it’s often easier for everyone if you deal with the accounts department directly.

When it comes time to settle up, ask for the contact details of whoever is responsible for actually paying your invoice. This way, you know they’ve actually received it, and if you have to chase them up you can get in touch with them directly.

Invoicing client

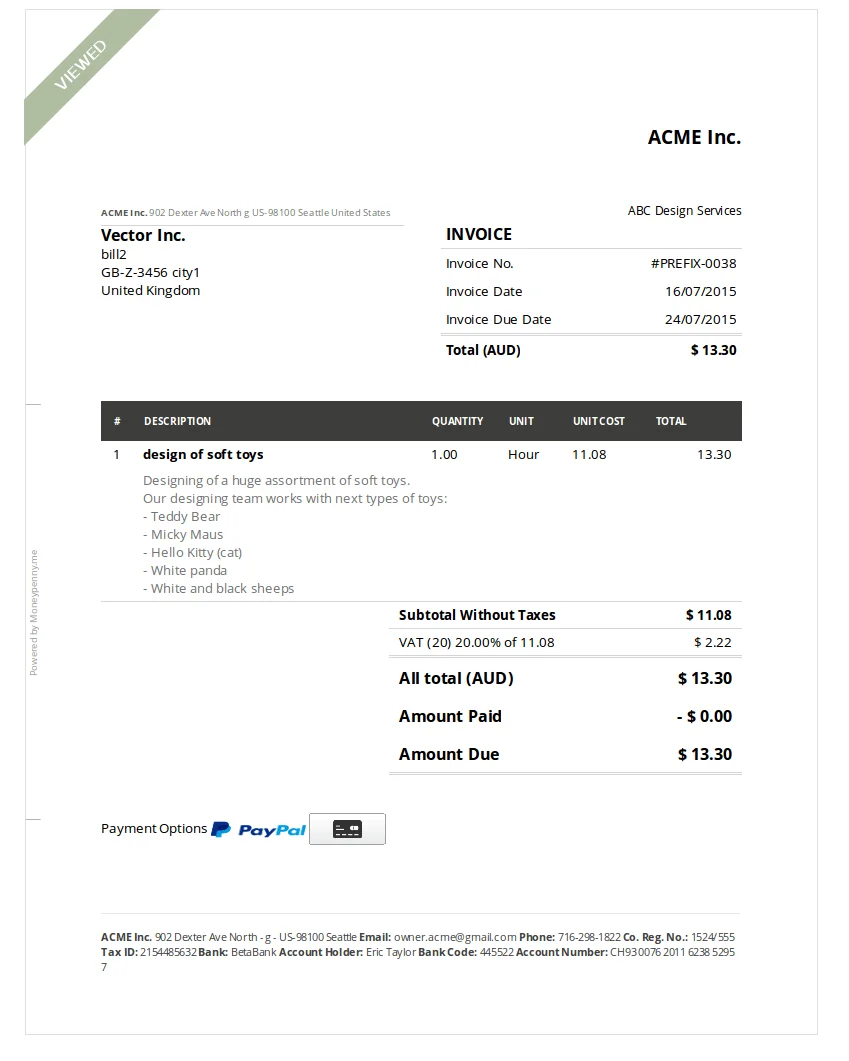

Before you begin a project and/or after a project is completed, you’ll need to create an invoice for your client. The invoice is simply a document that lists out the services you’re providing, and gives the total amount to be paid under the terms of your agreement.

You can create an invoice manually with your favorite word processor or spreadsheet software like Pages, Numbers, Word, Excel, or Google Docs.

Alternatively you can also invest in zistemo packages or cloud-based applications that can generate invoices for you. With zistemo it is easy and simple to create professional looking invoices, which will make total difference in creating invoice routine. zistemo can also offer additional features like expense tracking, time tracking, and account reports which are very helpful.

If you’re creating your own invoice from scratch, make sure to include:

- Your logo

- Reference invoice number (e.g. Invoice #00012) — This makes it easier for both you and the client when referencing to which invoice you’re talking about.

- Both your business info and the client’s

- Itemized tasks or services with the costs

- Chargeable taxes (typically not applicable for services, but double check in your area for what’s recommended)

- Total amount due

- Payment terms (e.g. Pay within 14 days of receiving this invoice)

- Payment options (e.g. PayPal, Square, or mailed check)

Setting payment terms

Just as important as how much the project cost, both you and the client need to understand how and when the project payment will be made.

Clarify in your invoice the due date for the payment of the balance due and specify that the files will only be delivered once the payment is successfully received.

Working under these terms will discourage clients from practicing unsavory behaviour like not paying you or stealing your work. You should also avoid sending any usable files until you’ve been compensated, although sometimes the circumstances may not allow this.

Here’s an example of some payment terms in its simplest form that you’d include on your invoice:

“Please send payment within 14 days of receiving this invoice. If you have any questions or concerns, please don’t hesitate to contact me. Thank you.”

It’s important to add that negotiation of these terms must occur prior to starting the project and should be agreed upon in the contract. Try to use the same terms for most projects, negotiate when needed, and always get a down payment.For almost every project, a 50% down payment is standard. The smaller the project, the larger the down payment. On small, less time consuming work, it might even be best to invoice for 100% upfront.

Should I put VAT on my invoice?

A common question, and one that never fails to stump new freelancers. If you’re unsure the answer is probably no. An invoice should only include VAT if the company issuing it is VAT registered. If you’re not sure if you’re VAT registered, you aren’t.

When should you send your invoice?

Well, this one is easy. As soon as your work is finished, and sooner if possible. If it’s a big job, consider asking for part-payment up front, or staggering your invoices at set milestones. Don’t delay in issuing your invoices, either. If you’re sticking to the standard 28 days payment terms, waiting two weeks to issue the invoice is increasing the time before you get paid by 50%, which is bad news for your cash flow situation.

You’re done!

Congrats, you’ve successfully invoiced your client. Next comes chasing payments, which is an entirely different kettle of fish.