What is a retainer?

Described simply, a retainer is an open-ended contract with a service provider. For this you pay an agreed fee and in return have access to their services when required. The main feature of a retainer is that the employer pays in advance for work that will be specified in the future.

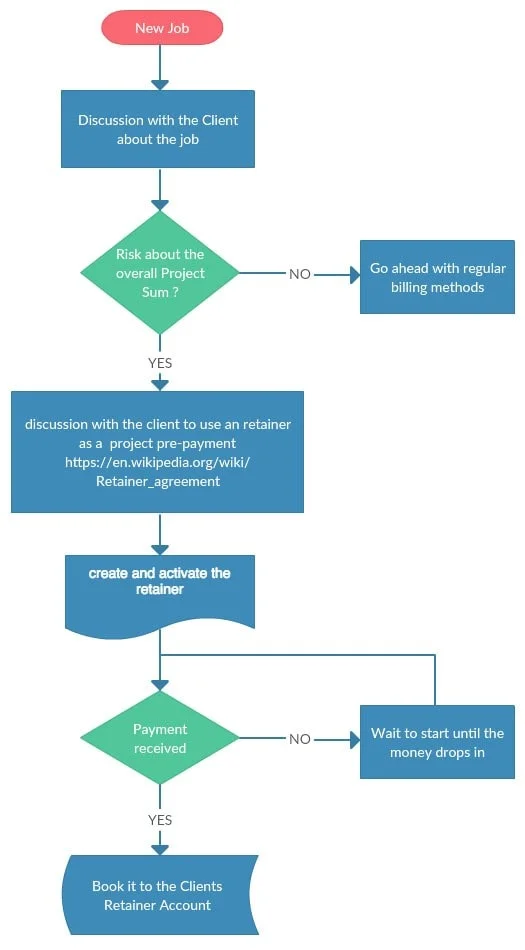

How does a retainer work?

Retainers are most often found in the areas of law, accountancy and HR but might also involve the use of specialist consultants in fields such as IT, energy or engineering.

The scope and nature of this support is something to discuss right at the start of the retainer process. When looking for retainers online, check out the level of service you’ll be receiving. Make sure this is at senior-level, ensuring you get the best advice delivered with enough flexibility to suit the needs of your business.

Although the agreed period is normally a year it’s also possible to agree on monthly or weekly retainers. Whatever the length, however, the retainer you’re paying for should meet your needs and, to this end, most companies can create a bespoke package for your business.

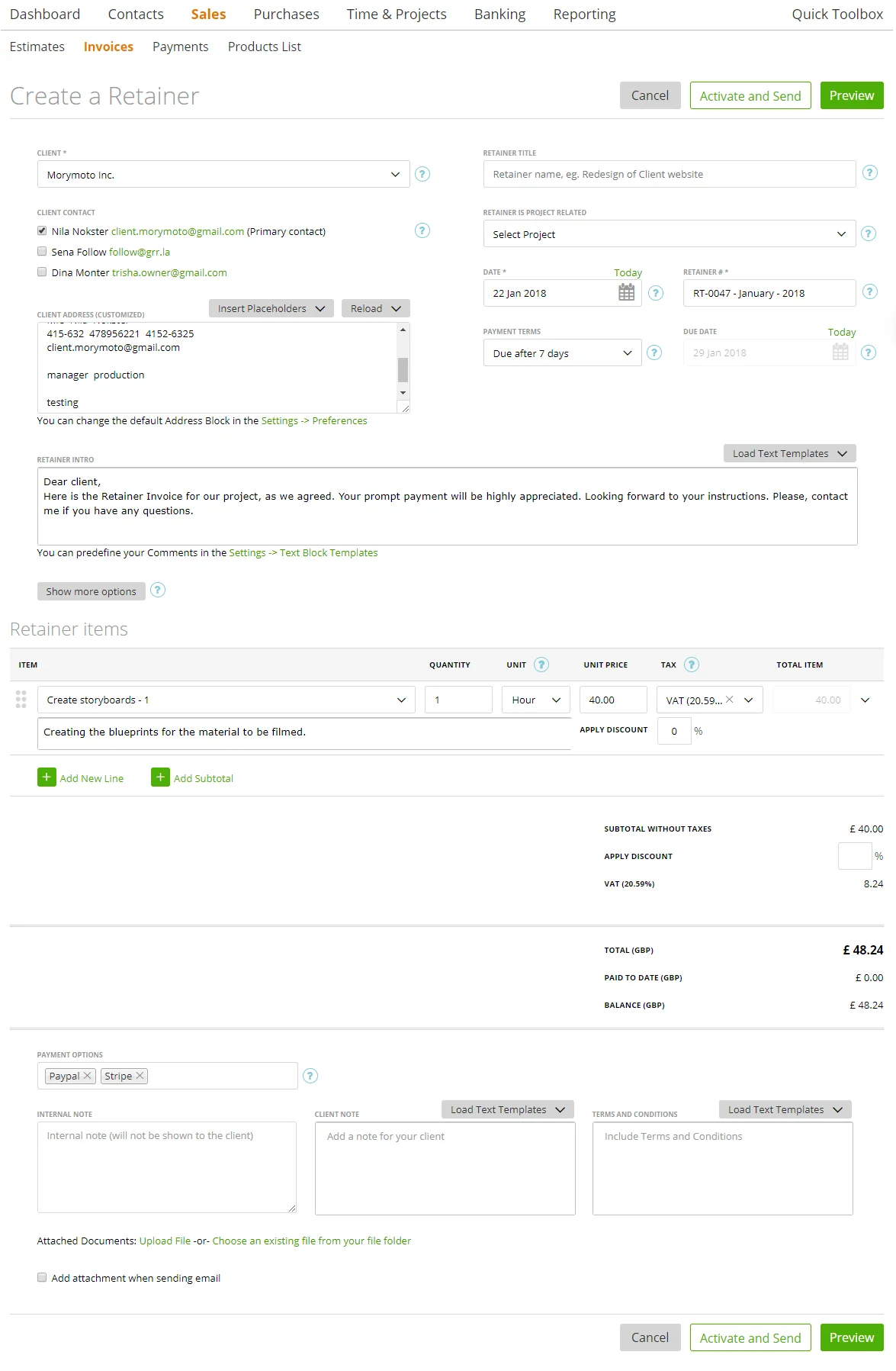

At zistemo, we offer advice on how to set up a retainer as well as providing personalised retainer proposal templates and simplifying the process of online retainer invoicing.

What is a retainer agreement?

A retainer agreement is a contract for services that are yet to be provided and usually falls somewhere between a one-off contract and full-time employment. In simple terms, it is when a client pays in advance either for a specified and time-bonded service or to retain the services of a professional consultant to use as and when necessary.

A retainer agreement is often negotiated between professionals in the fields of law, accountancy and human resources or consulting experts in areas such as energy provision and technology. It may be for a variable hourly rate or defined by a fixed term such as a monthly retainer agreement. Solicitors and barristers often enter into a retainer agreement with their clients which continues until a case is concluded. If the work isn’t carried out or not all of the money deposited is used, the unused part of the retainer fee is refunded to the client.

The advantages of a retainer agreement

Having a retainer agreement with a service provider is good for your business as it means you have a dedicated professional available to you for the period of time you have agreed and paid for. It also works well for the service provider as it allows them to budget their time and money over a financial period, whether this is a month or a year.

With a retainer agreement, you know that payment is guaranteed and can thus dedicate time and attention to delivering a high-quality service.

At zistemo we have retainer agreement templates and monthly retainer agreement samples designed to streamline your business and help keep your accounts in a straightforward and efficient manner.

What is a retainer fee?

The definition of a retainer fee is the upfront cost paid to retain the services of a professional consultant.

Have a look at our blog to find some advice how to get financial stability using retainer fees.

Unearned and earned retainer fees

An unearned retainer fee is the initial amount received before any work has commenced and does not belong to the person performing the service or task until the work is completed, for example, when a court case is closed and the client is billed.

Using the same legal example, with an earned retainer fee, a barrister would have access to the money once he starts work. The amount and timing of payments must be agreed between the service provider and the client. This could be in the form of a monthly retainer fee, actual hours worked or task milestones. For example, a barrister might receive 25% of the retainer fee once the pre-trial paperwork is complete.

For clients, it is important to remember that although a retainer fee is a payment for future services, it does not offer any guarantee as to the quality of the service provided. Some initial research is recommended before you commit yourself to an annual retainer.

If your company is the service provider, by using the retainer fee invoice templates available with your zistemo account, you can be sure any retainer fees you receive are handled correctly and efficiently.

Retainer Invoice

The definition of a retainer invoice

If you are offering retained services such as legal, accountancy or HR advice, the retainer invoice is a bookkeeping document that you will need to create at regular intervals. This document or invoice allows both provider and client to seamlessly enter the costs of the retained services into their account systems.

When you collect an advance payment for services not yet given, it can’t be classed as an income but as a liability against your company. You only start to earn the revenue once the service or product has been partially or wholly delivered. If at the end of the agreed period, the agreed service or product hasn’t been delivered, the whole or a proportion of the advance retainer payment has to be returned to the customer.

Keeping track of a retainer invoice?

Offering a retainer service can make accounting a little more complex but with the correct use of retainer invoices, both the provider and the client’s books should balance correctly. It is advisable to keep a close record of any time and services provided and invoice for shorter rather than longer periods - usually weekly or monthly. In this way, misinterpretations and miscommunications can be avoided.

Once a retainer invoice system is in place, your accounting systems can be set up to offset the deposit or retainer against an invoice. This then automatically transfers the retained money from its holding account into an active business account. With this system, your client can see at a glance how much of their retainer is still available. If the balance is getting low you can tailor your work accordingly or agree on a top-up payment with the client.

At zistemo we have retainer invoice samples designed to simplify and speed up your transactions. With your zistemo account, you can improve the service you offer clients while streamlining your own bookkeeping.