Profit and loss report, income statement, net income and operating profit: Can you guess where this is going? Yes. You’re right. It’s time to take the bull by the horns and ask the dreaded question:

How profitable is my business?

How much do you really earn, after paying rent, insurance, taxes, equipment and all your other expenses? Wait, what? You’re not entirely sure? No worries. You are not alone: Many new business owners actually pay themselves less than they give their employees. Freelancers, on the other hand, tend to overestimate their net income, because they don’t keep track of their expenses – a painful mistake, as we will see.

How much should I pay myself as a business owner?

(gzorgz / adobe.stocks.com)

This is a tricky question for freelancers and business owners alike. The obvious answer: As much as you need, and as much as your business can afford. It’s pretty easy to find out how much money you need for personal expenses. It’s a bit harder to find out how much your business can afford. To do that, you need to know how profitable your business really is. A profit and loss report can help you with that.

Start with Revenue

The start of all profit and loss calculation is revenue. Basically, revenue is all the money your business generates. If you’re selling apples, it’s the total amount you got from the happy apple buyers. If you’re a interior designer, it’s all the money your clients pay you for your services. Calculating your revenue is the fun part; the sum just gets higher and higher. Until you hit the top. Then it goes down again – unless you’re not paying rent, don’t have insurance or have any other business costs, that is.

What is your Operating Profit?

A rose is a rose is a rose, and profit is not just profit. Take for example the term «operating profit», also known as earnings before interest and tax (EBIT). Your operating profit is the business revenue minus all the direct business costs resulting from your operation: cost of goods sold, operating expenses or amortization and depreciation of long-term assets. Knowing your operating profit is a very good tool to measure the direct financial productivity of your business - no matter where you’re based, and what tax regulations apply to your business. But it doesn’t give you the whole financial picture. Because it does not take all of your finances into account.

Calculate your Net Profit

It is the net income, also called net profit, that shows the whole truth. Simply put: Net profit is revenue plus any other earnings, minus all costs – taxes and interests included. To calculate your net income, take your revenue and add the earnings from investments or interests; subtract your expenses, including debts or interests on loans you are paying. Voilà: you have calculated the net income of your business. More than that: You have created a professional profit and loss statement.

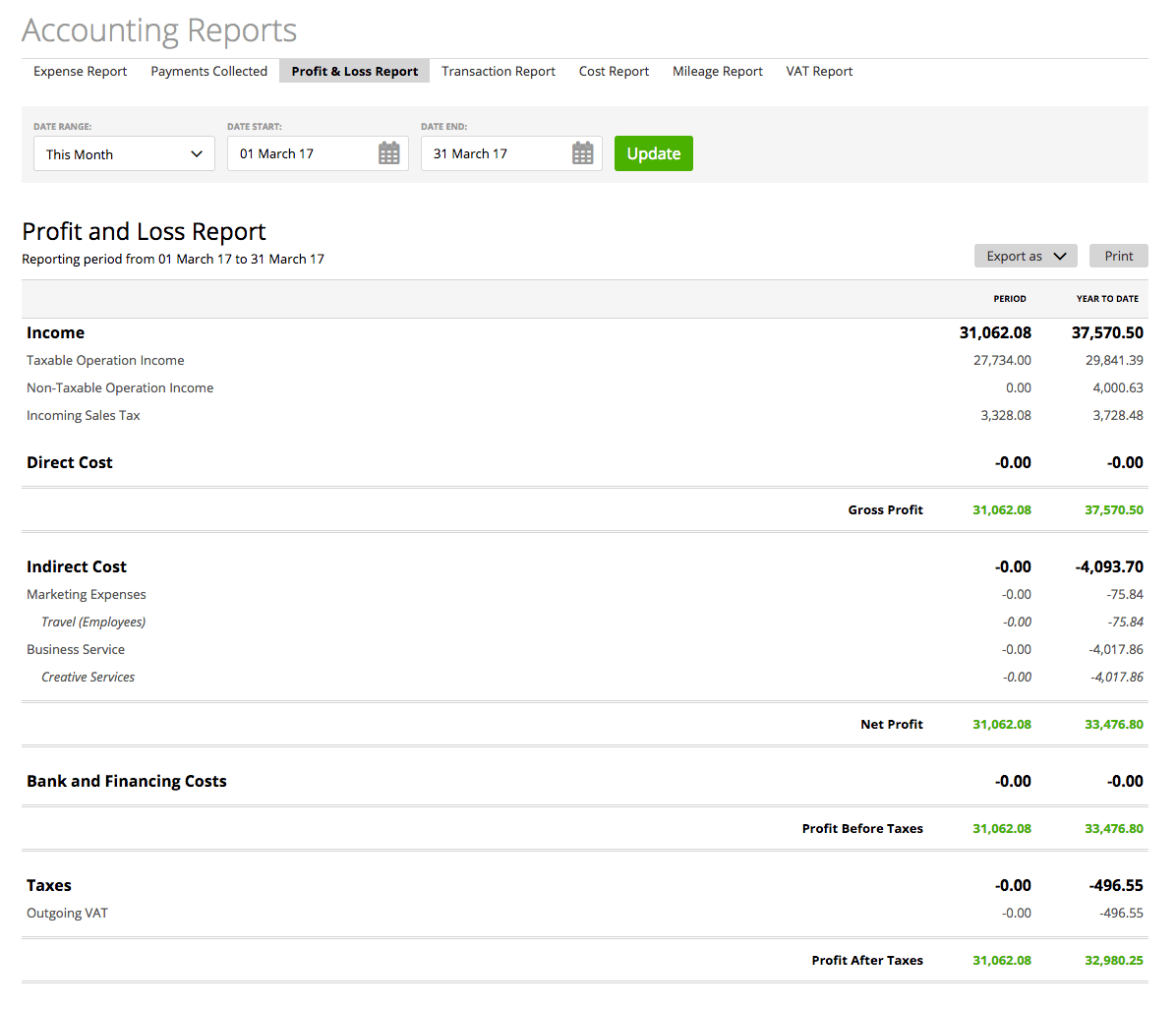

A Professional Profit and Loss Report - Source: zistemo

The Profit and Loss Report

The idea behind the profit and loss report is pretty straightforward. Take all of your earnings, subtract the costs, and look at the result. If it is positive, i.e. greater than zero: Congrats! You’re generating a profit, however small or large. If it is negative, no matter how much below zero: Take action. You are losing money. Right now.

Whatever the outcome of your net income or profit and loss statement: **The hard part is not getting the numbers right. **It’s getting them there in the first place.

The good news: Thanks to today’s technologies, it has never been easier to keep track of your numbers. Thanks to automatic expense capturing, online invoicing and smart reporting tools, you have your numbers ready without even lifting a finger. Except maybe once or twice to swipe through the app or click on the mouse pad - or to give your accountant direct access to your data.

It takes about 5 seconds to create a professional Profit & Loss Statement with zistemo. Including gross income, direct and indirect costs and Profit before Taxes. Exportable as .csv or .xls.

zistemo

The smartest Time Tracking and Invoice Software

Auto-magical accounting: That’s what we do. For you.

It’s like magic – only better. Because it’s smart, reliable accounting in the cloud.

How about you? How does smart cloud accounting make your life easier? Let us know!