Invoice definition

An invoice is an itemized “bill” of sale. It includes two parties: the issuer and the buyer. The issuer of the invoice is the “seller” of products or services. The “buyer” is the one who purchases what the seller is offering.

Businesses issue invoices when doing trade or providing services all over the world.

An invoice should include the address and contact info of both the buyer and the seller. Beside each product or service being sold, the unit price and quantity is also included, along with taxes or discounts, and then a total. The total is the amount that must be paid in full.

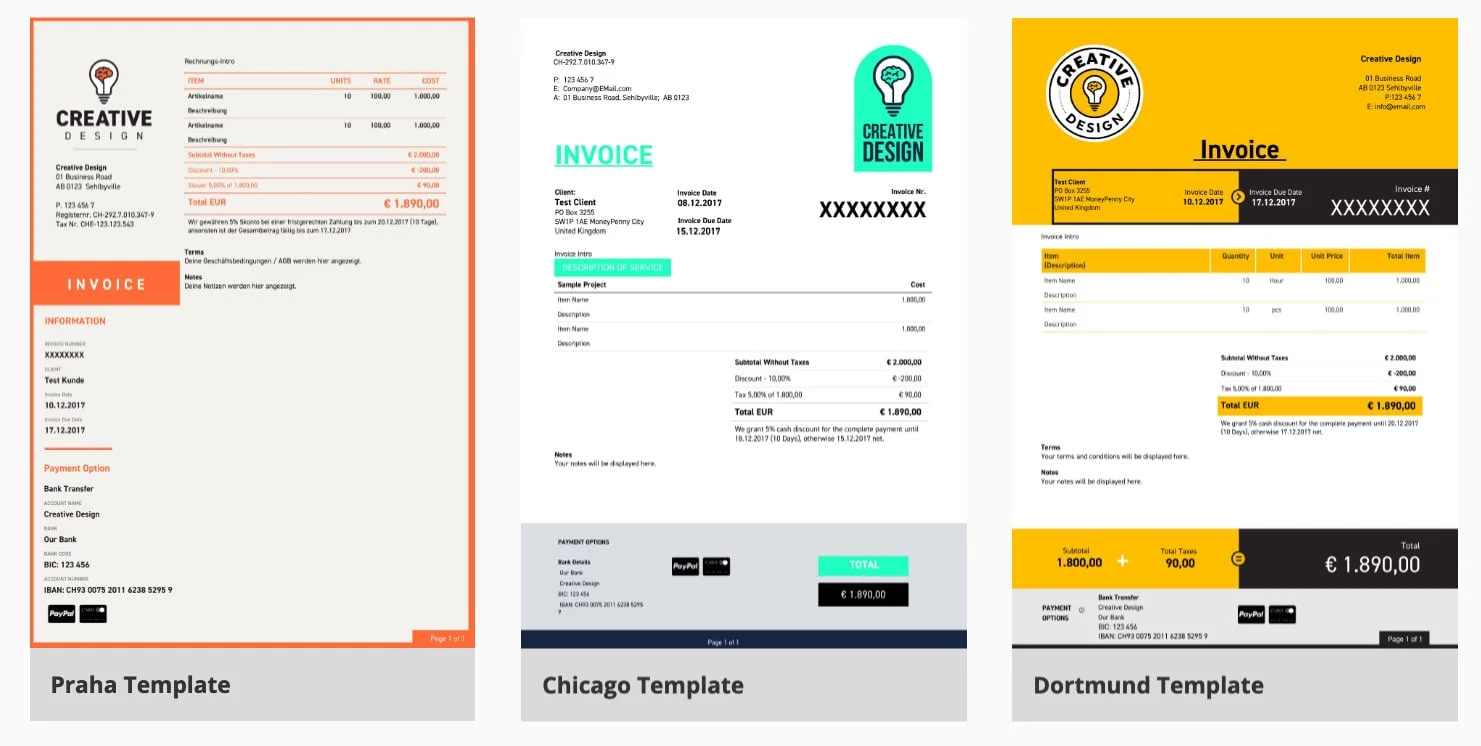

An invoice created with zistemo Invoicing Software

When to issue an invoice?

Invoices are usually issued according to the terms of a contract. Usually standard information like when to invoice a customer, how many times an invoice is issued or when it is payable by are all determined by the contract.

Invoices are sent out by a business once a service is complete or the product is ready for shipment or has been delivered. Once the buyer receives the invoice, it is expected to be “fulfilled” by a particular date. This means payment via cheque or bank transfer.

Payments for invoices

Usually, invoices are sent out by a business once a service is complete or the product is ready for shipment or has been delivered. Once the buyer receives the invoice, it is expected to be “fulfilled” by a particular date. This means payment via cheque or bank transfer.

It used to be the case that manual forms of payment or wires were the only way to pay an invoice. But with the rise of online banking and ecommerce, alongside changes in online payment systems .

PayPal and Stripe are now the norm to complete a payment transaction online. Any standard invoice generating software should (and usually does) have this functionality built in. If your businesses needs are quite simple, you’re just getting started or you’re a solo worker (like a freelancer), you can browse online for an invoice template to get a sense of what it looks like.

How does invoicing relate to the growth of a business?

When a business provides goods or services, they usually send the invoice along to the buyer. But there are pitfalls with invoicing. Especially if the buyer and seller exist far apart from each other.

Sometimes, a business can choose to have a condition built in to their invoice that says that they will not release a complete version of the service, until payment has been received in full. While it’s standard to issue invoices at the end of a job, not all businesses see payment right away. They must follow up with the buyer until the payment has been made and comes through.

Invoicing is, of course, integral to the business making income. But the act of invoicing and the process of getting paid are usually quite tedious. This is why small businesses and larger teams turn to invoicing software. They want to automate many aspects of invoicing.

Everything - including inventory, hours worked on a project, team members, hourly rates, unit prices, customer information and company logos - stay within this software.

When the business is ready to invoice, they simply generate all the information that lives within the system and, with a click of a mouse, they can send it to the recipient company.

Zistemo also allows businesses to track payment, change terms (example, applying late payment fees) on an active invoice, and automate billing (for, example, monthly invoices). The information on revenue, expenses, net income and outstanding invoices are all displayed neatly on the dashboard, within the software.