Are you a new business owner? Did you just get your first order and you need to issue an invoice? Do you really know what is an invoice and what an invoice should include?

As some of you may have some doubts how to issue correct invoices here are the basic information every business owner and freelancer should know.

8 Essential Elements Each Invoice Must Include

- The word Invoice

- Seller’s name and address, contact details and company registration number

- Buyers name and address

- Date: invoice issue date, payment due date, delivery date

- A unique invoice reference number

- Description of services or products including quantity, cost per unit and total item cost

- Total amount charged with Tax Information

- Available payment methods, including bank account number and a reference code identifying the customer

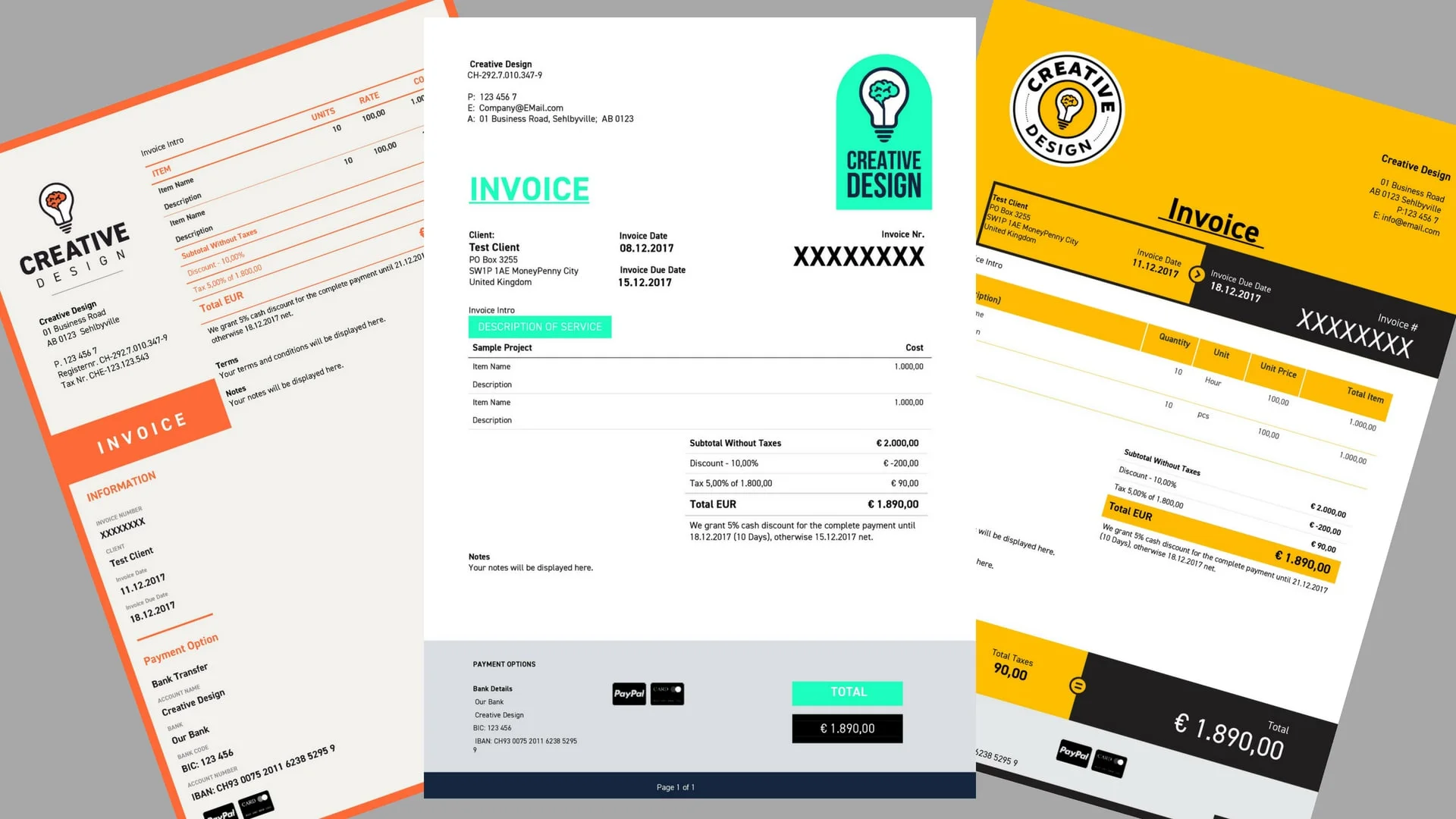

Invoice Templates created with zistemo Invoice Software

An invoice – definition

An invoice is a document issued to customers by a seller asking for payment of goods or services. It is also known as a bill or tab. Invoice is a document presented to the customer before or after supplying the goods or services. It is a legal document that can be annulled with a credit note if issued incorrectly.

If you are a seller, you are not allowed to simply remove an invoice from sales records. Your Businesses is probably registered for VAT (value added tax) and you need to issue invoices in line with specific regulatory requirements.

Zistemo can help you with invoicing. Simplify your invoice process and get paid faster. Try it for FREE for 14 days.

In the rental industry, an invoice indicates the duration of the time being billed. The invoice amount takes duration into account in addition to price, quantity and any applicable discounts. A rental invoice typically itemizes the actual hours, days, weeks or months being billed.

What does invoice mean?

Invoices typically track the sale of a service or product for tax, accounting and inventory control purposes. The majority of commercial enterprises supply the product or service and expect payment on a later date. Businesses are increasingly transmitting invoices digitally rather than on paper. The documents present the sales details in an itemized form.

A seller views the document as a sales invoice while buyers consider it a purchase invoice. The term invoice is synonymous with monies owed and it indicates the buyer and seller. This form of nonnegotiable commercial instrument assumes the role of document of title when paid in full.

Make sure that your invoice consists of all essential elements. You can do this easily and for FREE with FREE Invoice Generator

What is invoice number?

The invoice number is undoubtedly the second most important number on a tab after the amount due. You can assign the number in a variety of ways. It all depends on the seller’s preference or requirements. Invoice number is a unique identifier. It helps the seller search for the document on a computer or in a paper file.

The majority of accounting software employ sequential numbering by default. Some businesses prefer using client level numbering, which employs a reference prefix like MB001 for invoices involving the customer – Melody Boutique.

What invoice number should I start with?

Choosing a practical invoice numbering system allows you to stay well organized. The simplest way to number invoices is the global invoicing numbering system, which starts at 001.

Most accountants prefer the system for its simplicity in tracking payments. Larger commercial enterprises often use the project level sequencing system. It applies a prefix that is related to a project, such as ROTRIXOO1 for a project named Rotrix.

The best numbering system does not complicate the invoicing system or confuse clients. The client level system allows easy searching based on a prefix that identifies the clients - MP001 for zistemo.

What is invoice address?

The invoice address refers to the physical home or business premise where the seller sends the bill, invoice or receipt. The address is usually identical to the one appearing on the customer’s credit card or check account. It is the shipping address where goods are delivered. The invoice also identifies the address and name of seller.

Why are invoices important?

Compiling and sending invoices to customers can be a time-consuming process, but it is unavoidable. But using the documents like invoices will help you get paid on time and in full. An invoice provides legally admissible proof that your services and goods were delivered. It also helps to establish the seller’s right to payment. An efficient invoicing system provides sufficient legal protection when faced with a tax audit. Invoices enable businesses to substantiate reported income.

When to invoice a client?

Invoicing before delivering the goods or services is a practical option when working on small orders. This approach comes with increased pressure to deliver the goods or services, but eliminates the possibility of non-payment. Receiving upfront payment helps improve cashflow, particularly in small businesses.

Invoicing after the delivery of goods requires a high level of trust and can be risky. Rectifying instances of non-payment costs money in legal costs or debt collection agency fees. Sellers providing services to clients can invoice the first 50 percent on contract approval and the rest upon project completion. Invoicing for larger projects can be broken into three or more milestone-based payment requests.

Now you know a lot about invoices. It’s up to you whether you want to create an invoice template in Word or Excel or use zistemo to deal with it. If you choose zistemo register here for a 14 day FREE TRIAL.

Kind regards,

Thomas

Please be aware that there might be other requirements in your country or your business and it is recommended to review your legislation to cover all national requirements.

Do you know why the right accounting software matters to law practices? Read more