What is an Accounting System?

An accounting system is a system that is employed in a company to organize financial information. It can be either manual or computerized. The main reason why you should be using an accounting system is to keep track of expenses, income, and other activities. Basically keep an eye on all data that affect the finances of a business organization.

Accounting System Definition

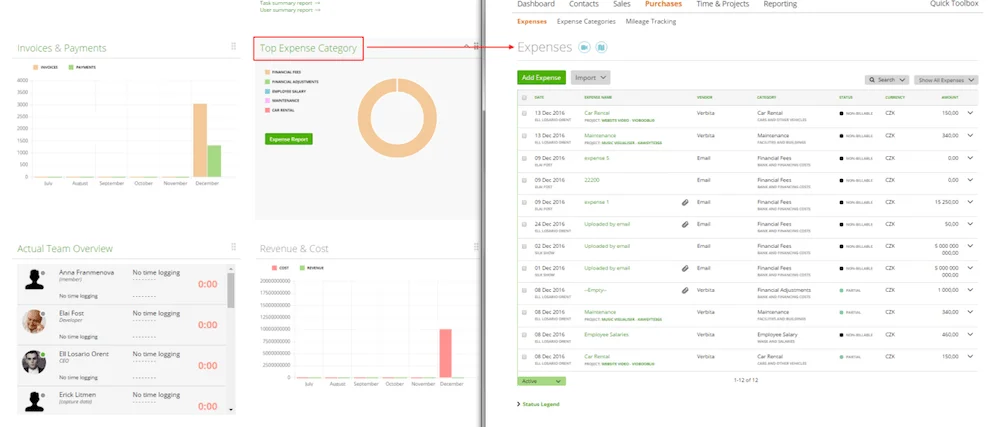

Accounting system helps businesses to keep track and manage their financial transactions. That includes sales, purchases, assets and liabilities. Business accounting system is particularly helpful when you need to generate reports. As a business owner you probably already know that proper data reports impact greatly the process of decision making. In the past all data where gathered manually. Luckily today we are living in a computerized age. And that allows us to store the financial records easily. Now you can enter all the data, change them and interpret simply by logging into your accounting system on your computer or mobile phone.The past, loads of manual calculations, would be involved to balance out the ledgers.

Types of Accounting Systems

1. Managerial Accounting

This type of accounting provides managers with necessary information for planning and operations control. Under managerial is cost accounting and lean accounting. Cost accounting records the cost incurred by the business for various transactions and operations. Lean accounting is for process examinations to determine how to reduce cost and eliminate wasting resources while increasing value.

2. Inventory Accounting

These provide a means to track and plan inventory levels and other activities that are related. Barcode tracking and RFID are some of the common inventory accounting systems available.

Zistemo can help you with your accounting and billing. Simplify your business finances. Try it for FREE for 14 days.

3. Industry Specific Accounting

This refers to a system tailored for a specific industry. For example, a system for a sales business and legal accounting have significant differences. Each has their specific requirements suited for the different industries.

4. Not-for-Profit Accounting

This type of accounting has its unique requirements too. It mainly involves ensuring that finances are channeled to the right direction. The system should be able to produce expenditure reports.