1. VAT Report

2. Generate VAT Report

1. VAT Report

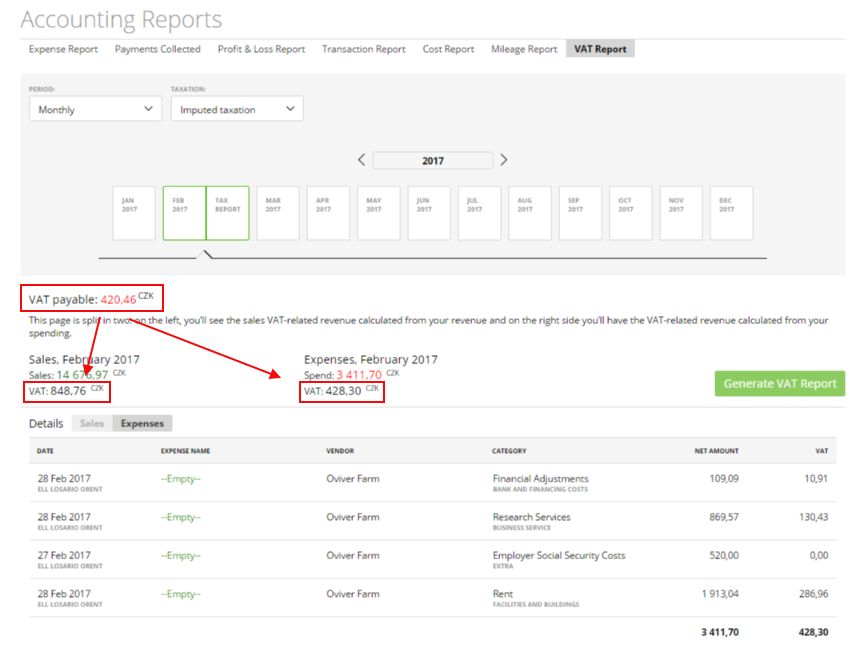

The VAT Report shows your company’s activity by including the following:

– how much money you got from selling goods or services;

– how much money you spent on purchasing goods or services;

– the VAT amount from sales and purchases, which can be a negative or a positive value.

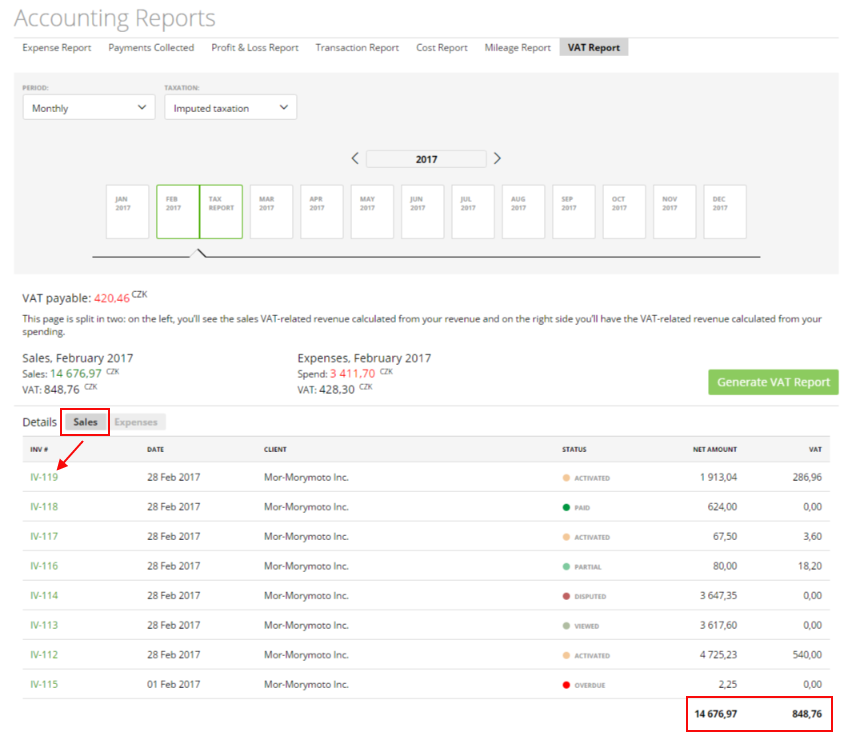

The VAT Report is divided into two tabs: Sales and Expenses.

The Sales tab

The Sales tab shows the company’s revenue and the related taxes amount. It includes only invoices (active and archived) with the next statuses: “Activated”, “Viewed”, “Disputed”, “Paid”, “Overdue” and “Partial”.

Hint: You can review an invoice by clicking its number in the report table.

The Invoice Amount is split into Net Amount and VAT Amount. The Net Amount is displayed with discount (if a discount is applied).

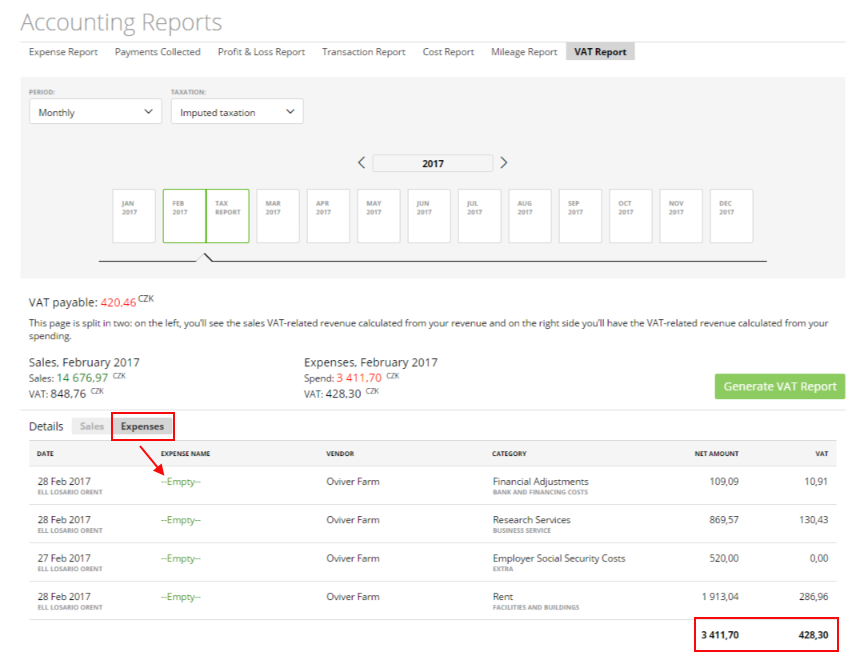

The Expenses tab

The Expenses tab includes the expenses (active and archived) with all statuses: “Non – Billable”, “Unbilled”, “Billed”, “Partial” and “Paid”.

Hint: You can review an expense by clicking that expense name in the report table.

The expense amount is split into Net Amount and VAT Amount (if the tax is applied). The net amount is displayed without admin fees.

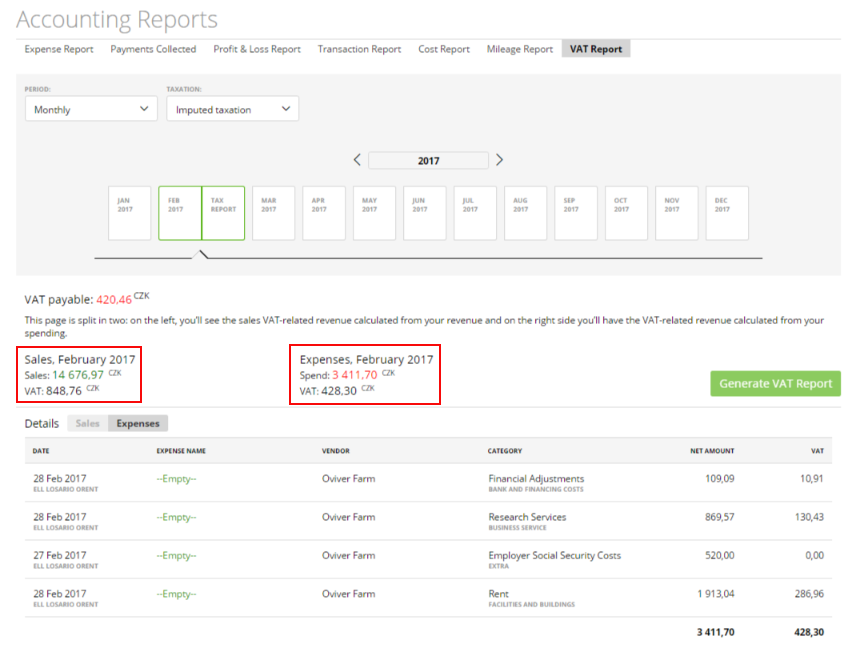

In the report header, you can compare the total net amount of the sales, the total net amount of the expenses and the VAT amount for the current period.

VAT amount from the sales – it’s a summary of invoices taxes for the chosen period ( a month or quarter) – part of products’ cost sold to or paid by the buyer.

VAT amount from the expenses – it’s a summary of expenses taxes for the chosen timeframe (month, quarter) – part of products’ cost purchased by your company.

So:

VAT payable = VAT from sales – VAT from expenses

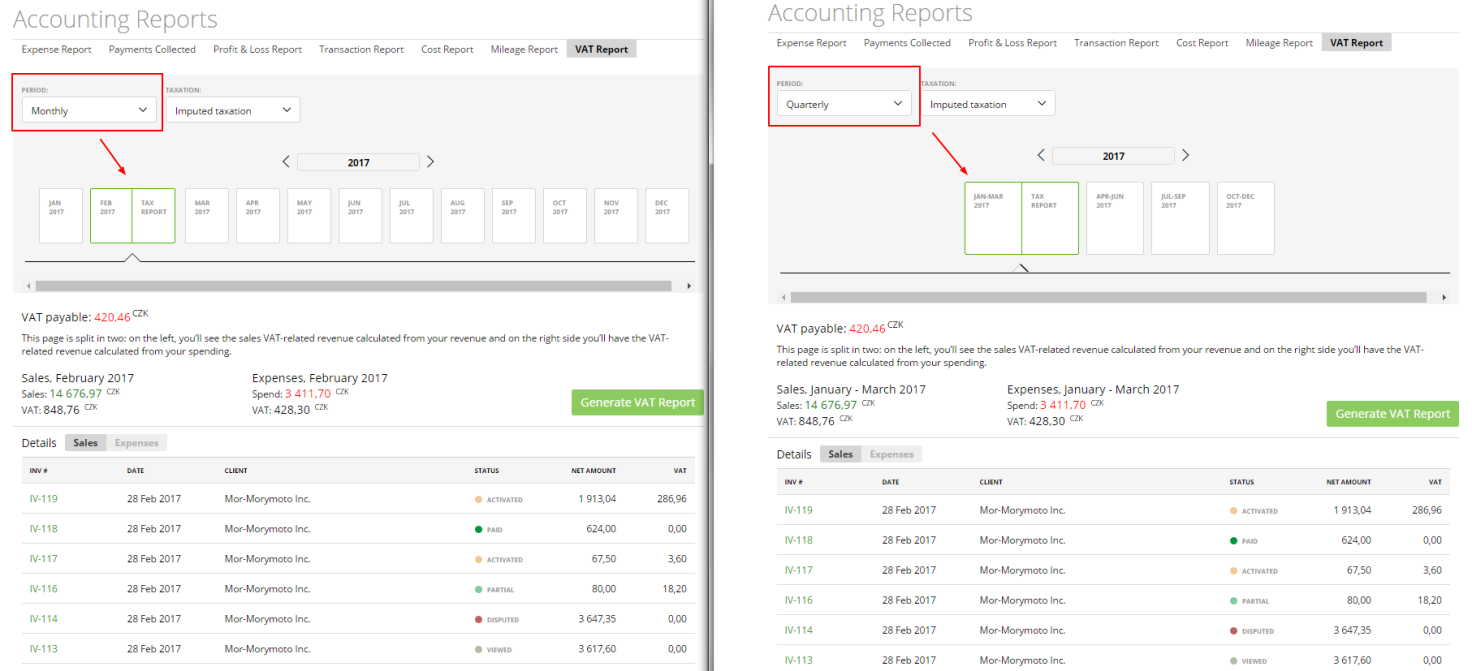

You can group the VAT Report data by month or quarter – just pick the desired timeframe from the drop-down list.

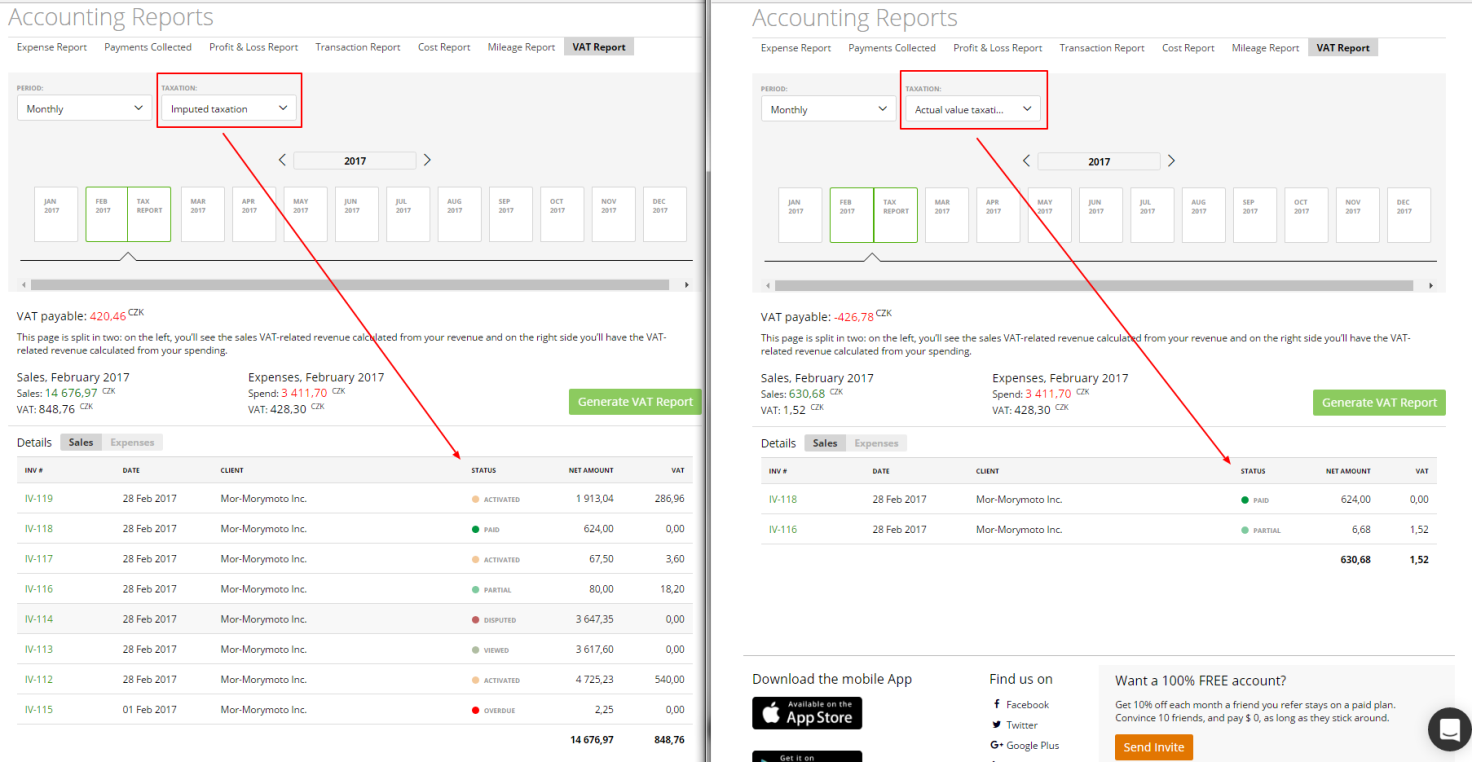

Another useful tool is the “Taxation” filter, which includes two options: Imputed taxation and Actual value taxation, where:

– “Imputed taxation” displays data for all invoices.

– “Actual value taxation” shows only “Paid Invoices” data.

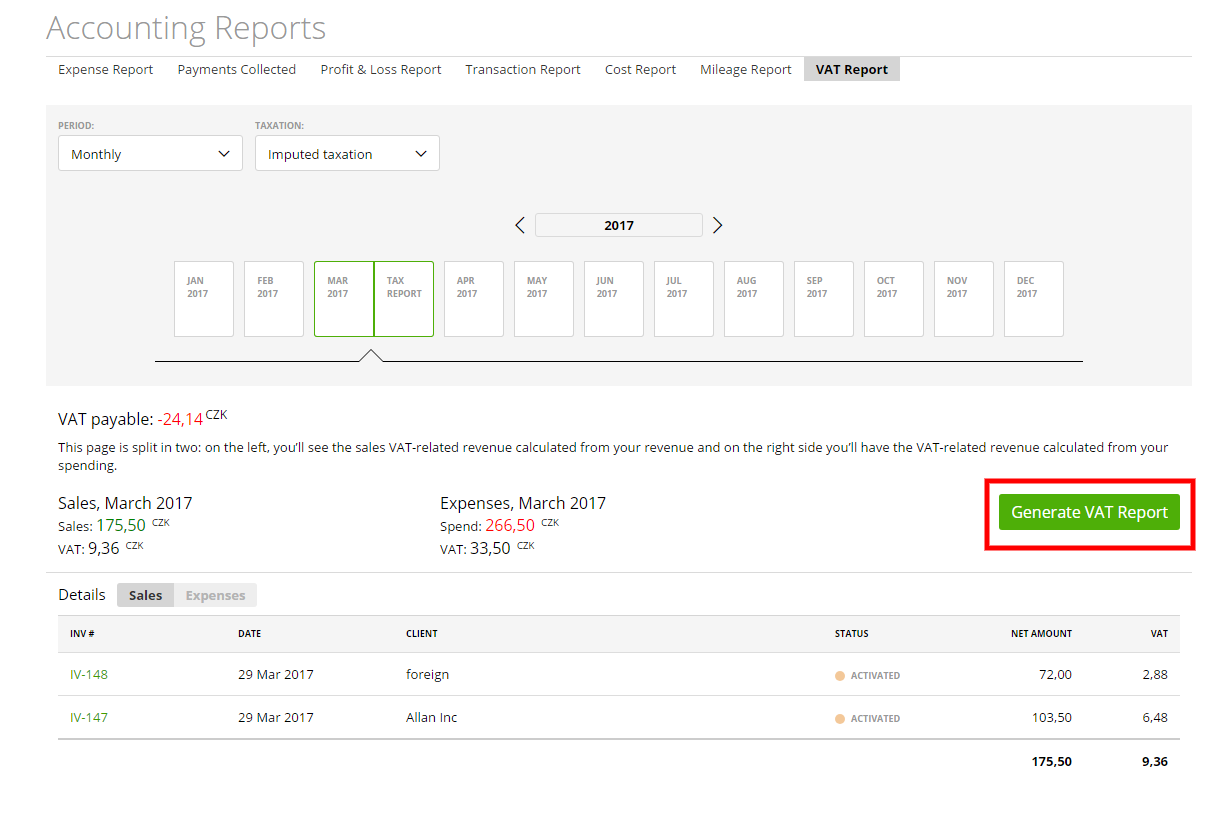

2. The “Generate VAT Report” function

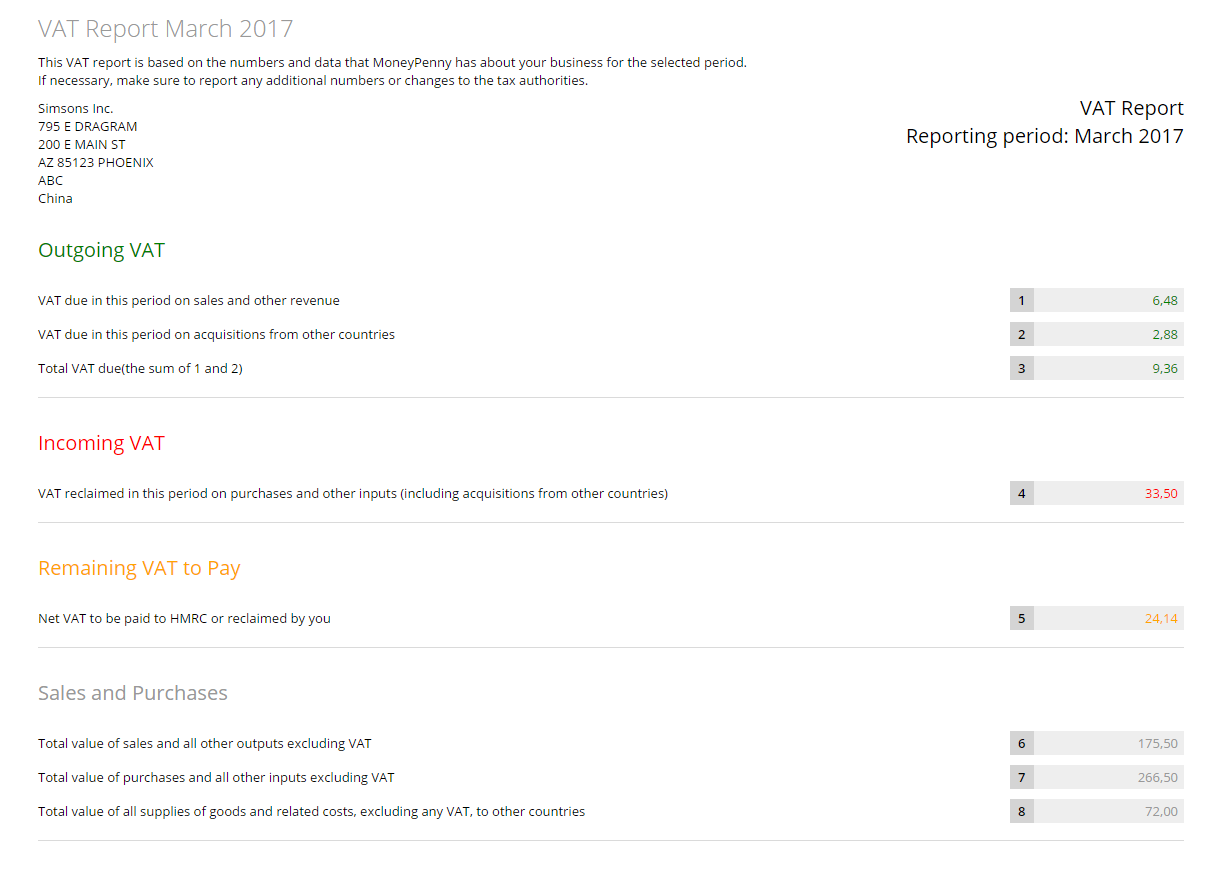

If you’re interested in a summary of the data comprised in your VAT Report, then you should use the “Generate VAT Report” button. This Report is an extension of the VAT Report and it groups data in 4 blocks: Outgoing VAT, Incoming VAT, Remaining VAT to pay and Sales and Purchases. All the information can be grouped on a Monthly or Quarterly basis, depending on which period is chosen in the VAT Report.

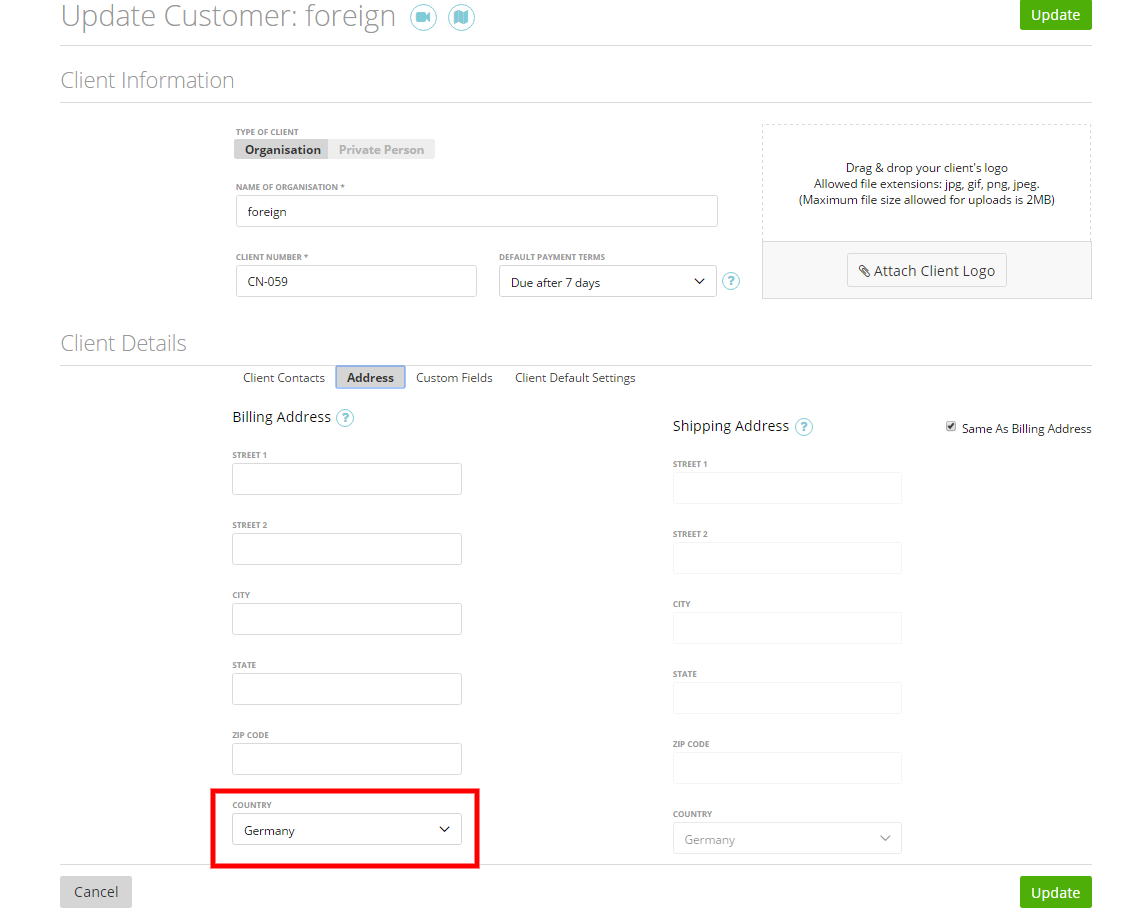

The Report distributes data separately for the foreign clients and the clients located in the same country as the company account.

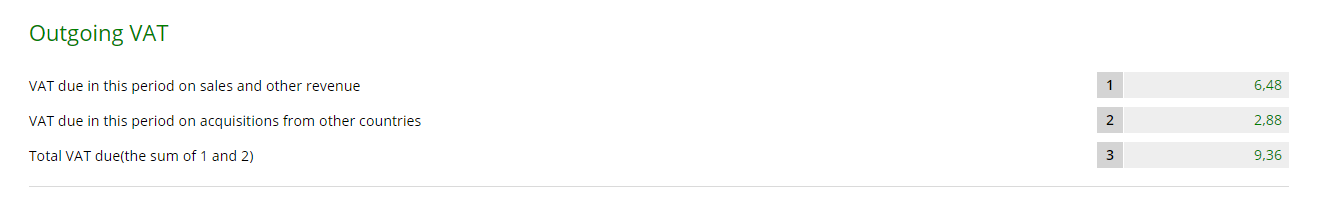

The block “Outgoing VAT” includes the first, second and third rows of this Report:

1. VAT due in this period on sales and other revenue – it’s the total amount of taxes from the invoices created for clients located in the same country as the company account.

2. VAT due in this period on acquisitions from other countries – it’s the total amount of taxes from invoices created for the foreign clients.

3. Total VAT due summarizes the first row (VAT due in this period on sales and other revenue) and second row (VAT due in this period on acquisitions from other countries).

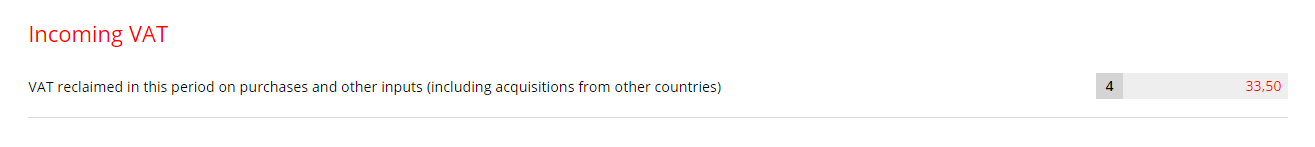

The block “Incoming VAT” includes the fourth row of this Report:

4. VAT reclaimed in this period on purchases and other inputs (including acquisitions from other countries) – it’s the total amount of taxes for all the expenses created (except non–billable) which are assigned to all clients, disregarding their location.

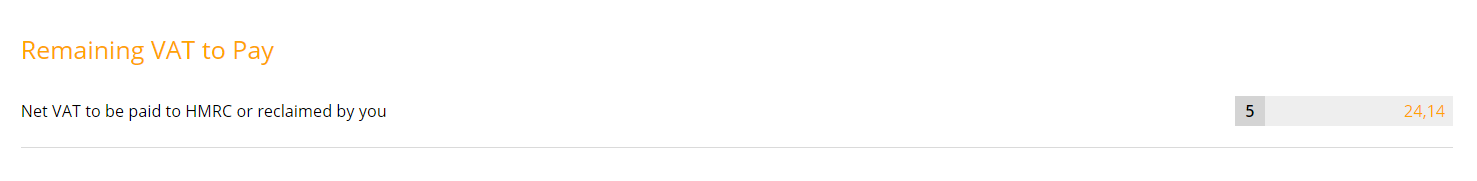

The block “Remaining VAT to pay” includes the fifth row of this Report and shows the difference between the fifth row and third row of the Report:

VAT reclaimed in this period on purchases and other inputs (including acquisitions from other countries) – Total VAT due

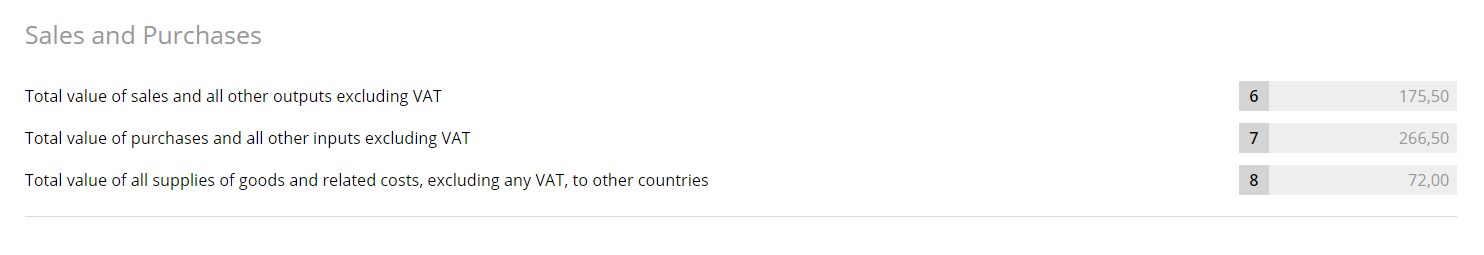

The block “Sales Purchases” includes information about the next row:

– The total value of sales and all other outputs excluding VAT – it’s the total amount of invoices created for all clients. This total amount includes “Discount” and “Without Taxes”.

– The total value of purchases and all other inputs excluding VAT – it’s the total amount of the expenses created (except non-billable), related to all clients. This total amount excludes “Taxes” and “Admin Fees”.

– The total value of all supplies of goods and related costs, excluding any VAT, to other countries – it’s the total amount of invoices created, related only to foreign clients. This total amount also includes “Discount” and “Without Taxes”.

Note: even if you change the country on the “Invoice” page, the amount of this invoice and the amount of taxes will always be related to the country indicated in the address tab of your client. The country in the address tab has a higher priority if it is the foreign client or the client located in the same country as the company account.

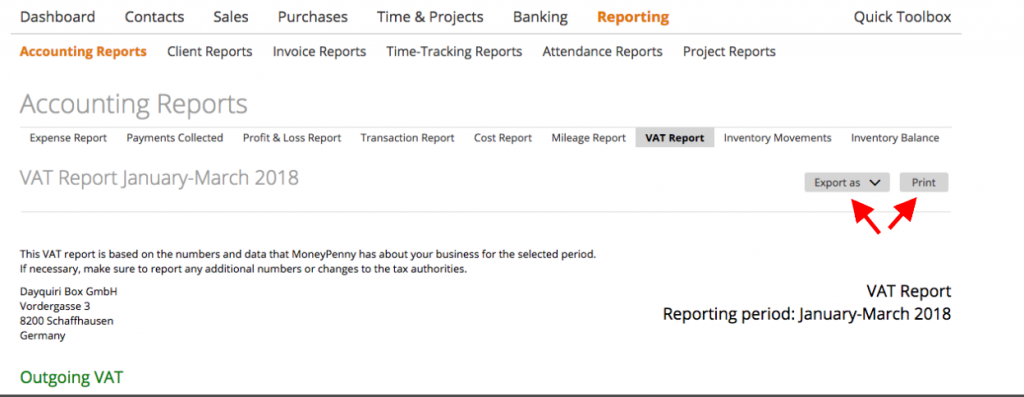

You can also download your VAT Report as PDF or Print it: