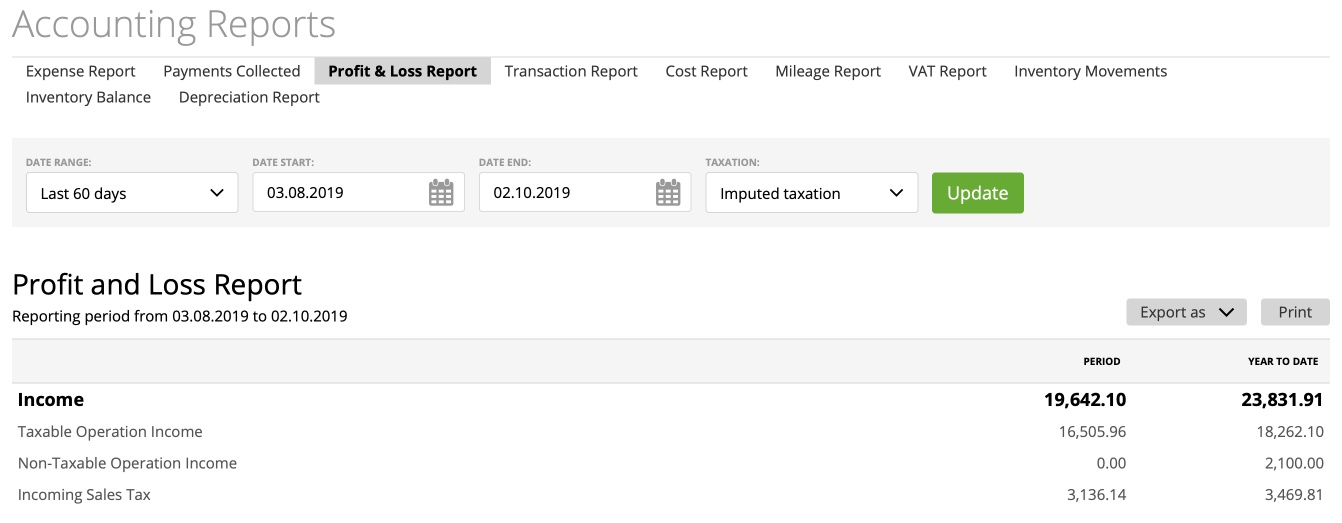

The “Profit and Loss” Report shows the net profit or loss your company gets during an accounting period by subtracting costs from incomes.

Income basically means the company’s revenue from the taxable and non–taxable operations. The “Income” category includes the next subcategories:

– Taxable Operation Income – a summary of all taxable items and tasks, included in invoices (active and archived) with the following statuses: “Activated”, “Viewed”, “Disputed”, “Paid”, “Overdue” and “Partial”. These items and tasks are displayed with the discount amount (if a discount is applied) and without taxes amount (if the tax is applied).

– Non-Taxable Operation Income – a summary of all non–taxable items and tasks, from invoices (active and archived) that have statuses such as: “Activated”, “Viewed”, “Disputed”, “Paid”, “Overdue” and “Partial”. These items and tasks are displayed with the discount amount (if a discount is applied).

– Incoming Sales Tax – a summary of all taxes which are excluded from the “Taxable Operation Income” (taxes amount of taxable items and tasks).

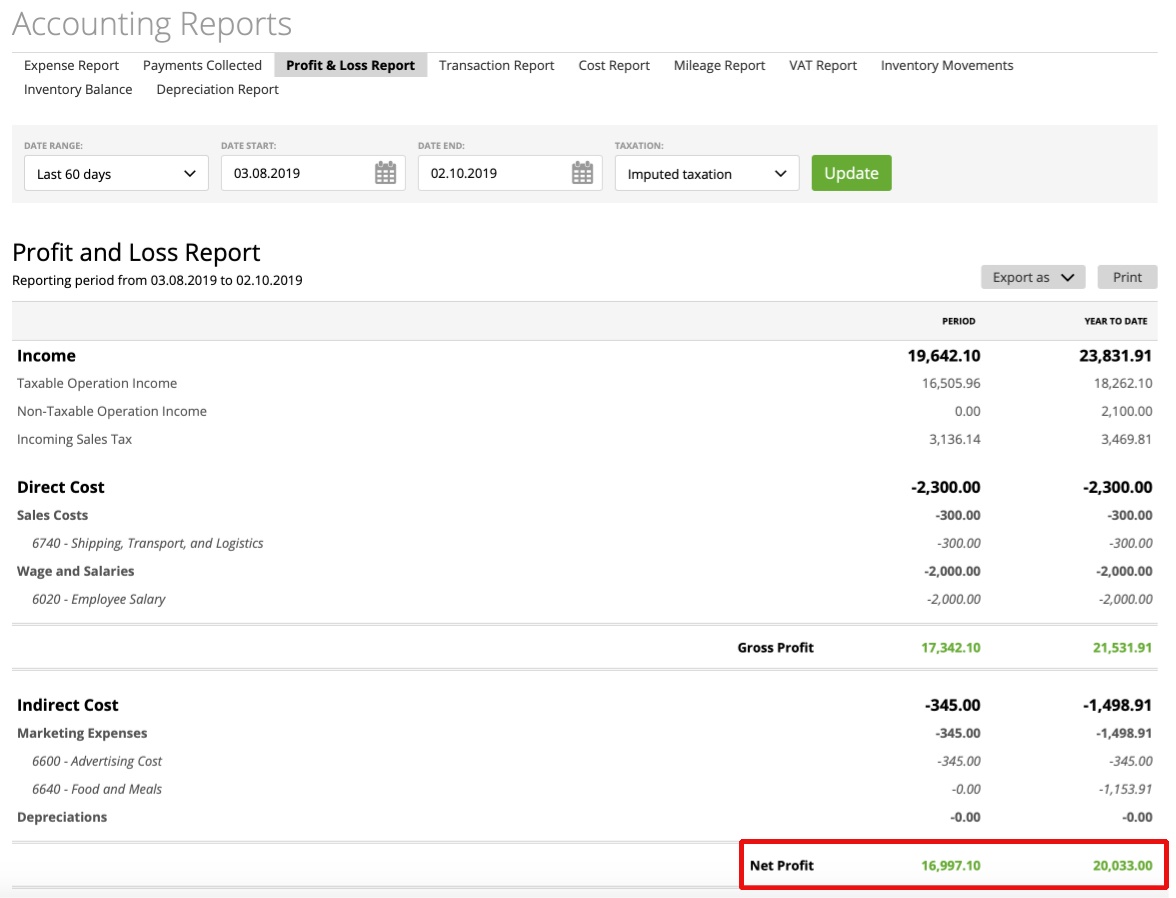

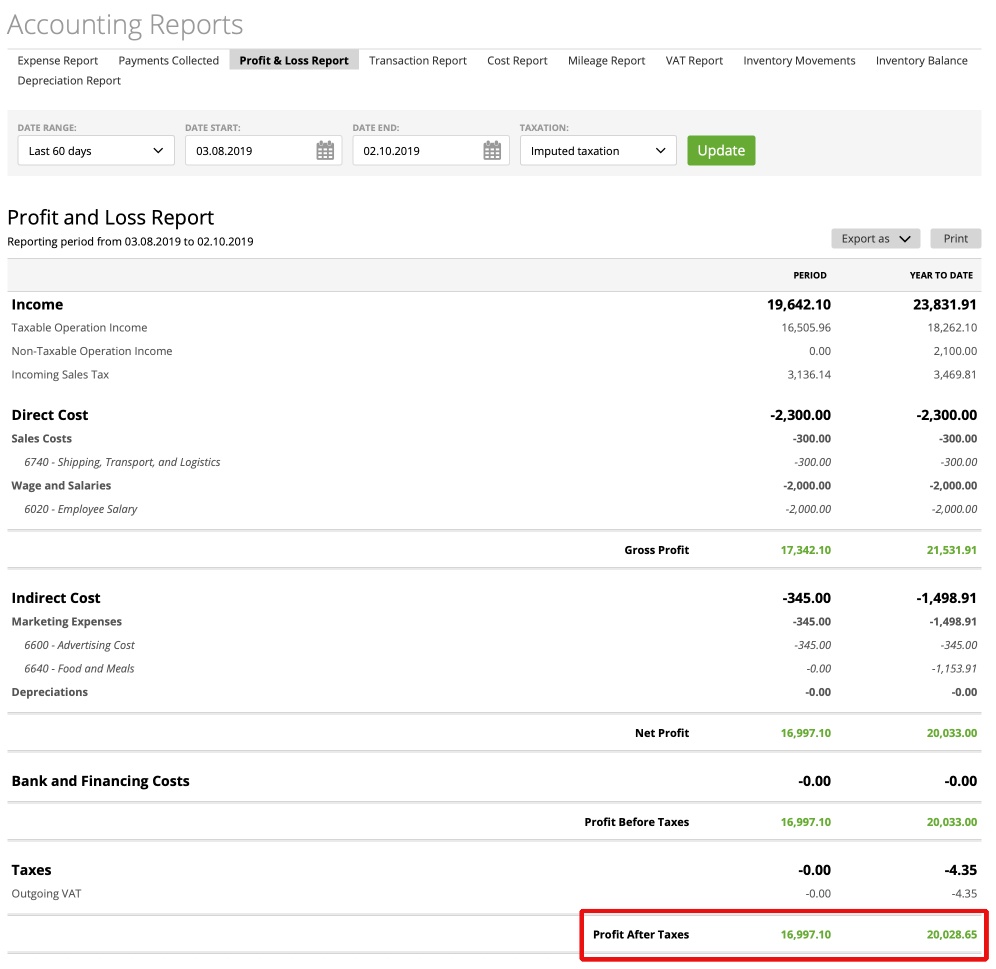

In zistemo, “Costs” refers to your company’s expenses (active and archived). The costs in this report show the expenses summary without Taxes and Admin Fees.

The “Cost” category includes next subcategories:

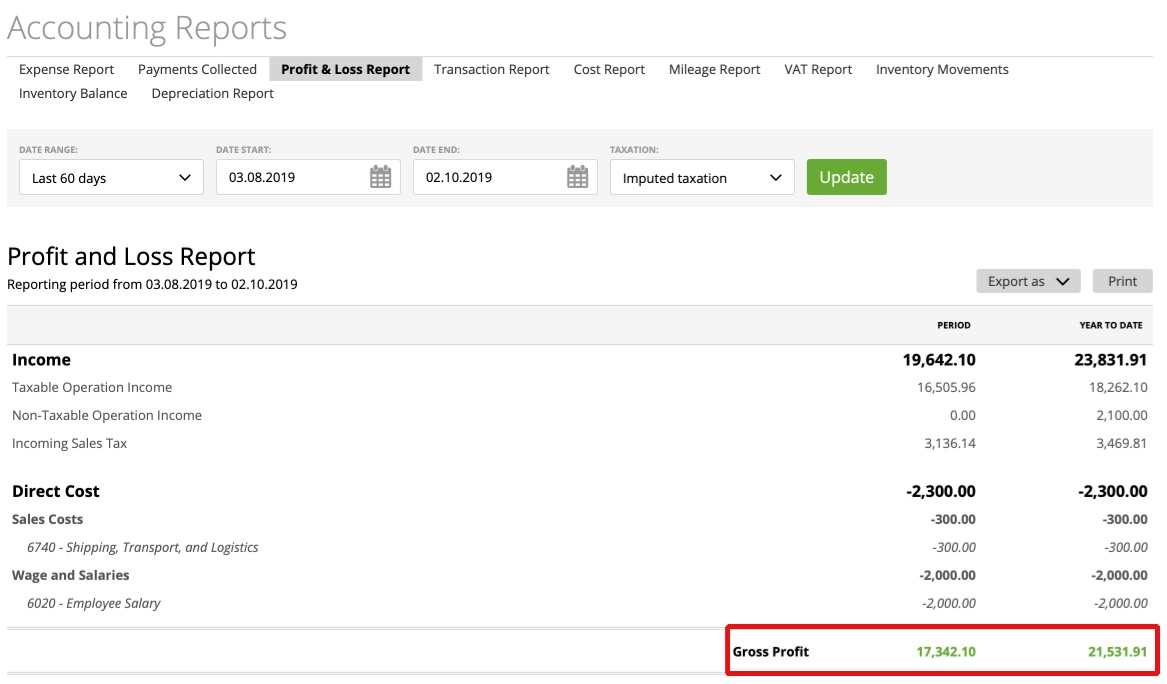

– Direct Cost (includes the Sales Costs, Inventory Purchase, Wage, and Salaries):

Income – Direct Cost = Gross Profit

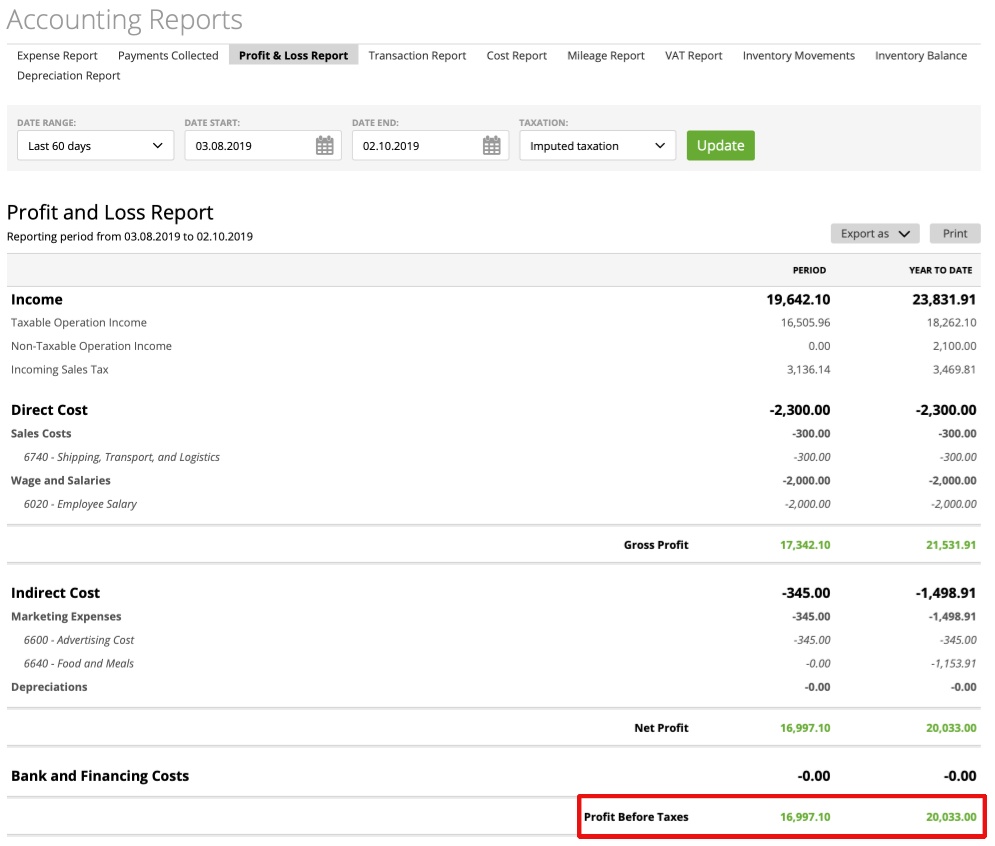

– Indirect Cost (includes the Marketing Expenses; Business service; Office; Facilities and Buildings; Cars and Other Vehicles; Properties, Plans, and Equipment; Intangibles; Insurance and Fees, Legal and Accounting Fees; Extra; Sales and No Category).

Note: the subcategory “No Category” includes the expenses without category – in zistemo, it could happen when you automatically create an expense by sending an email – more here.

Gross Profit – Indirect Cost = Net Profit

– Bank and Financial Cost:

Net Profit – Bank and Financial Cost = Profit Before Taxes

– Taxes (includes the Taxes and Outgoing VAT).

The subcategory “Outgoing VAT” is the taxes summary of the all taxable expenses.

Profit Before Taxes – Taxes = Profit After Taxes

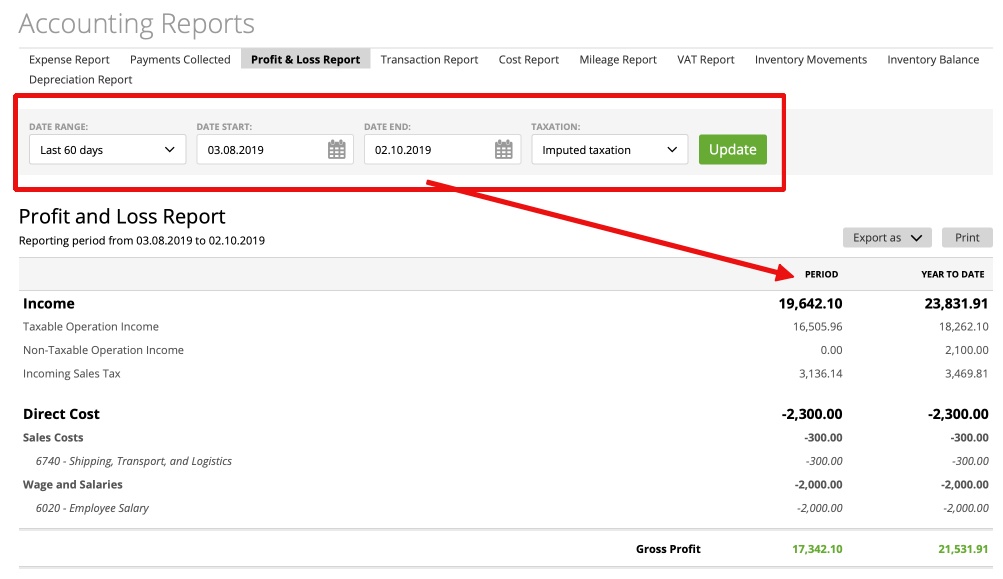

The “Profit and Loss” Report allows you to compare data from a specific period or from the beginning of the year, up to date.

The column “Period” shows the data according to the chosen date range from the drop-down list (or date range from “start date” to “end date” chosen manually).

The column “Year to date” displays data from the start of the year – from the first invoice/expense of the current year to this year’s last-created invoice/expense.

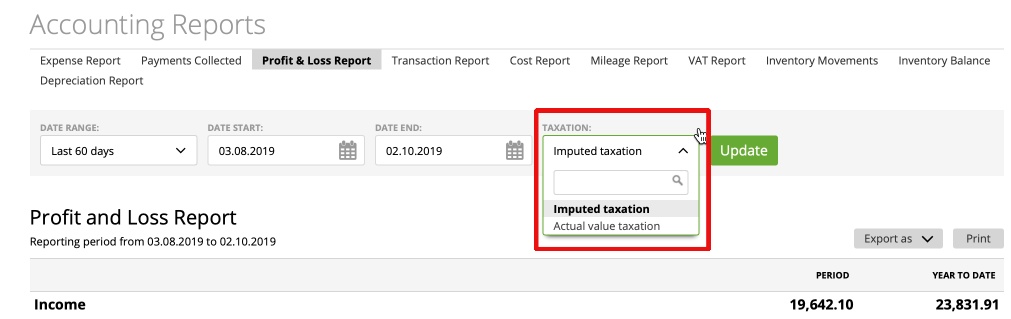

Also, you can use the “Taxation” filter, which includes two options: Imputed taxation and Actual value taxation, where:

– “Imputed taxation” displays data for all invoices.

– “Actual value taxation” shows only “Paid Invoices” data.

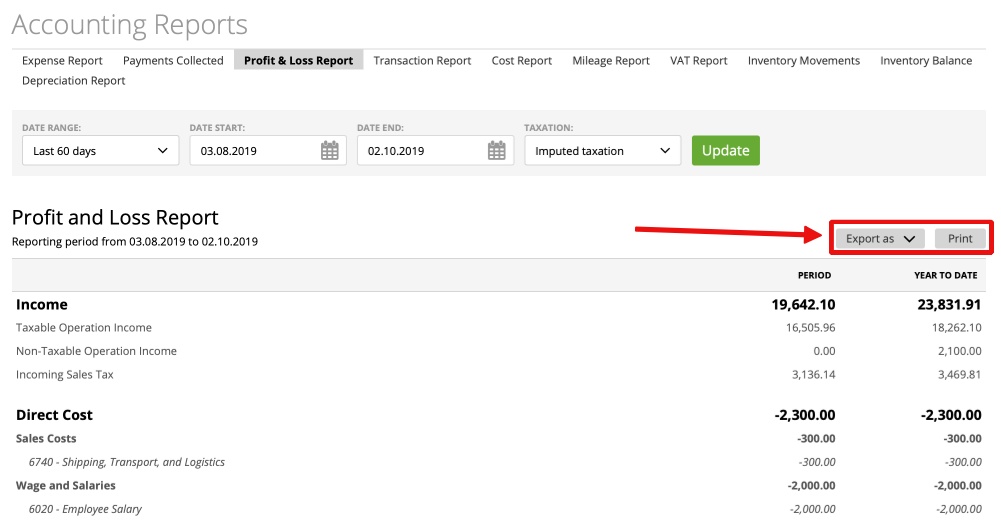

At any time, you can export as PDF or print the “Profit and Loss” Report:

Important: the “Profit and Loss” Report doesn’t include the following expenses: Owner Payment and Owner Withdrawal.