How does the sales taxes feature work?

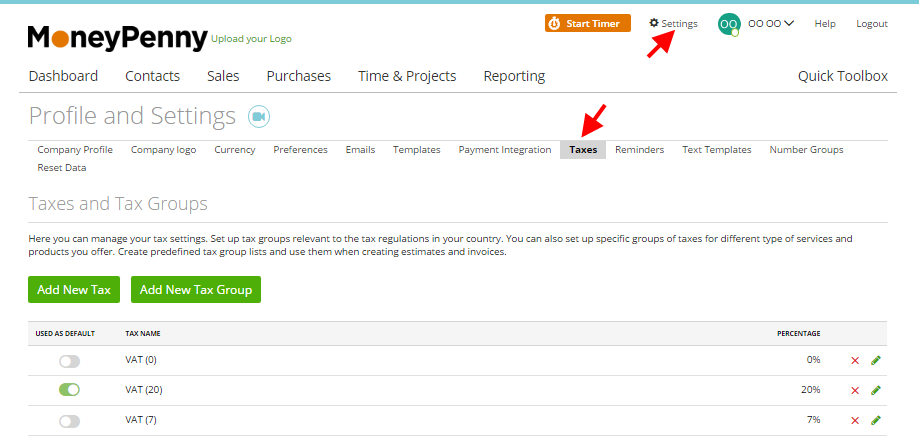

You can customize the sales taxes of your business at, Settings ➝ Taxes.

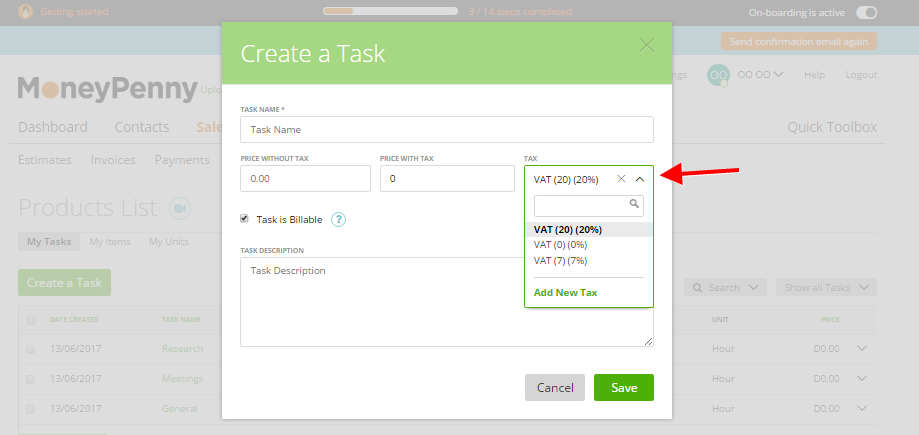

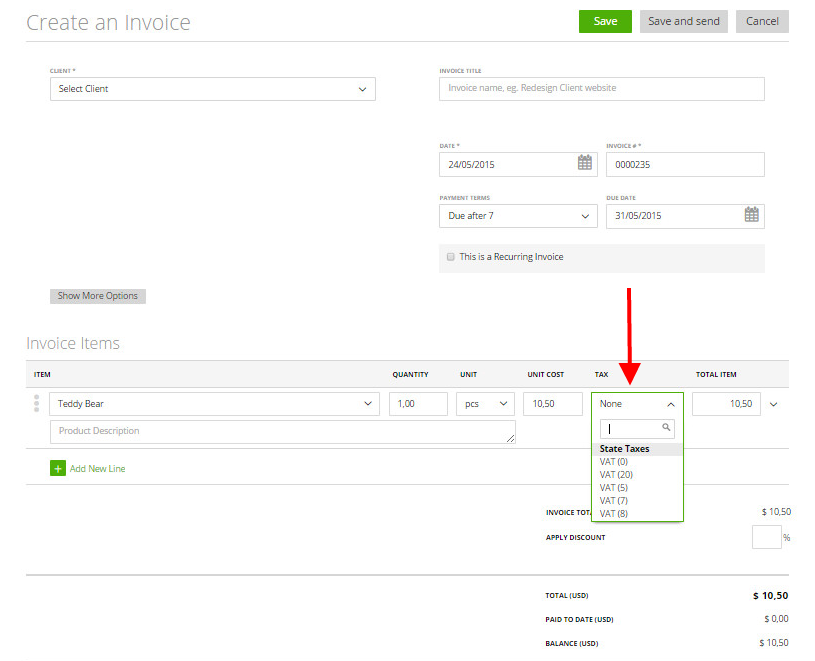

You can then add taxes to the price of your products. As a default, product costs exclude taxes meaning the total price will consist of the product cost and the additional tax.

You can also choose to include taxes on the initial product amount during the raising of invoices or estimates.

Taxes with 3 digits after the decimal point

zistemo supports taxes with 3 decimal places. If you use taxes with 3 numbers after the decimal point in your business – just add this tax to any tax fields. It will not be rounded automatically, so you will see the correct taxes on all your zistemo documents.