Invoice disputing and commenting

Invoice Payment

The difference between deleted and archived invoices

Invoice disputing and commenting

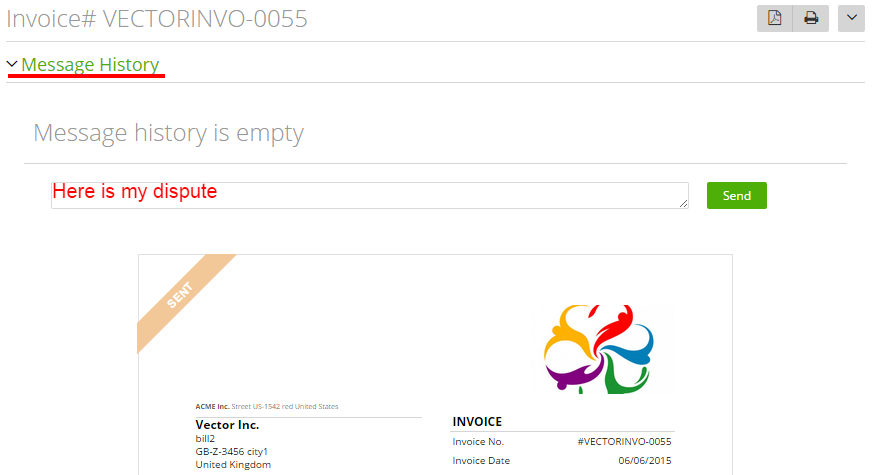

Before paying an invoice your clients are able to dispute it.

To dispute an invoice they will need to open the invoice preview (by clicking on invoice name on the grid) ➝ click ‘Message History’ ➝ insert their comments and click ‘Send’.

Then the status of your invoice will change to ‘disputed’.

The account owner and staff members can respond to the client’s dispute in the same way.

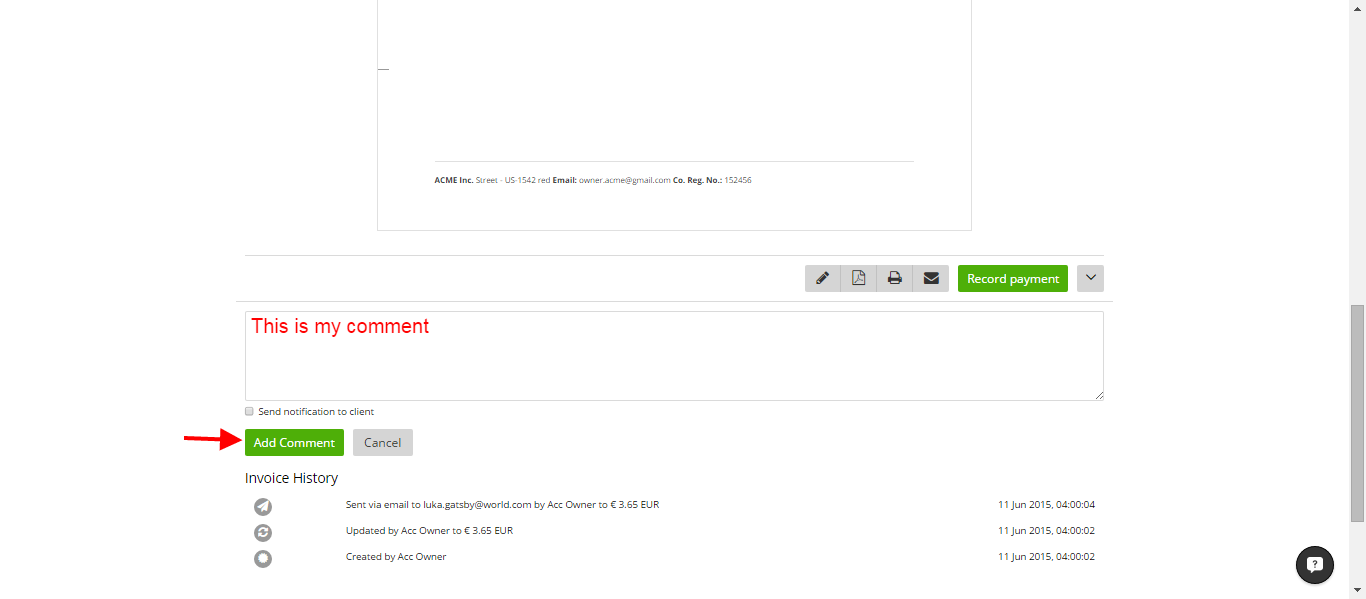

You can also make comments on an invoice in the invoice history, at the bottom of the invoice preview page. Click on ‘+ Add Comment’ link ➝ inserting a comment and clicking ‘Add Comment’

These comments will be visible to all users of your account (owner, staff, clients, tax consultant)

Invoice Payment

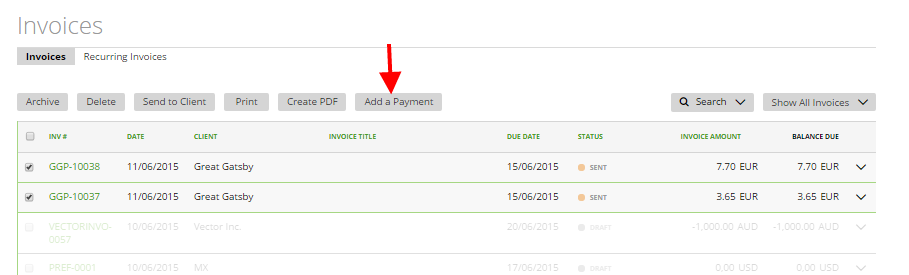

Invoices can be marked as ‘paid’ in two ways:

- record payment by an account owner or a team leader;

- online payment by clients.

To record a payment go to Invoices ➝ choose invoices (mark check-boxes) ➝ click ‘Add a Payment’

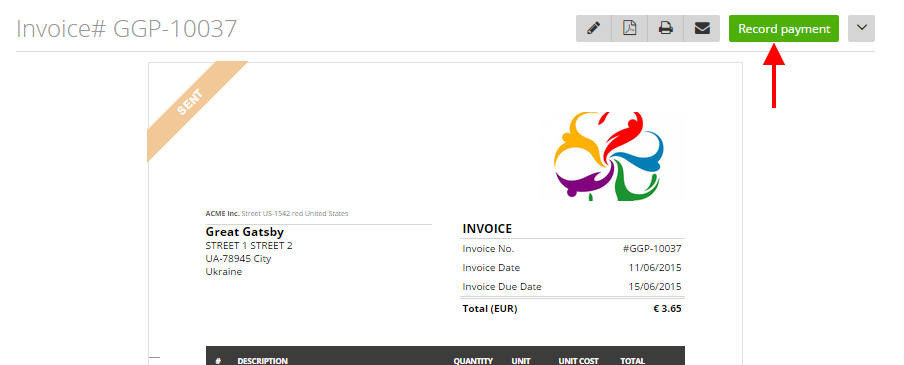

…Or open the invoice preview (click on the invoice number on the grid) ➝ click ‘Record Payment’.

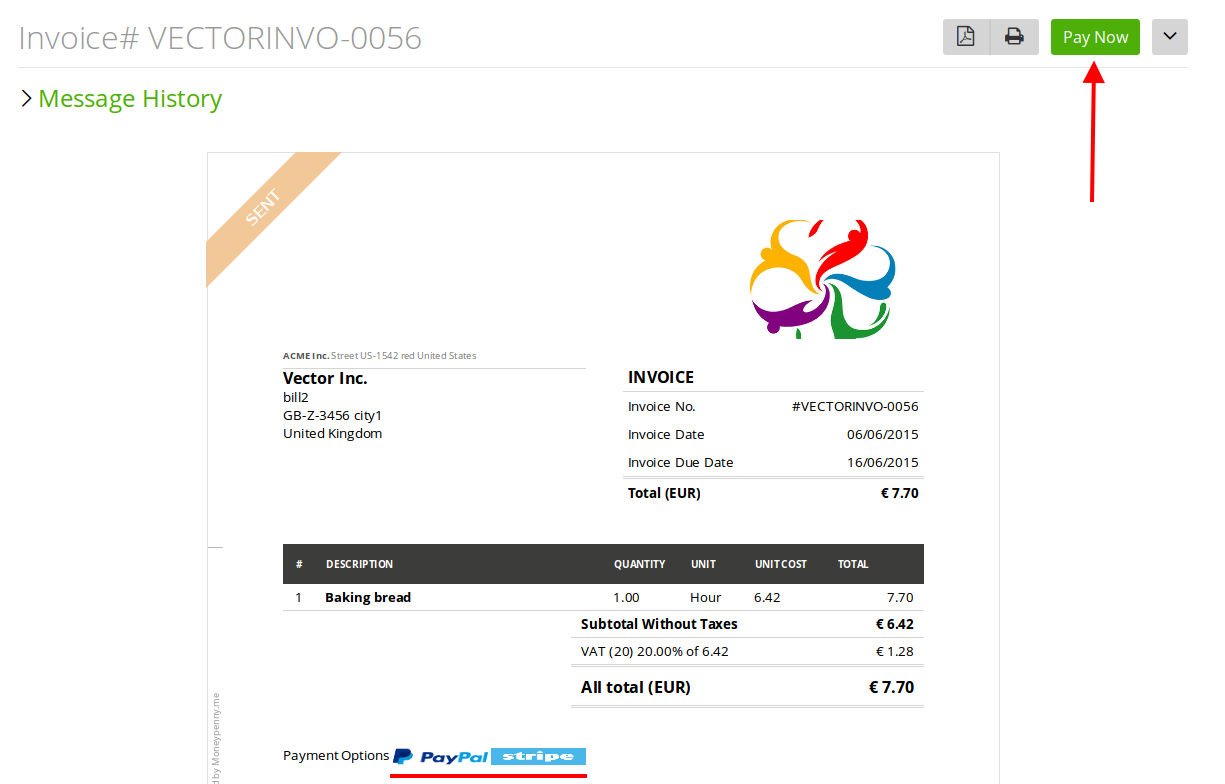

To make an online payment from the client’s side (from the client’s profile), go to the invoice preview and click ‘Pay Now’.

Then follow the payment process to complete the payment.

The difference between deleted and archived invoices

You can delete or archive invoices.

Archived invoices – you can no longer take any actions with these invoices and your client will not see them in their profile. However, this invoice data will be still be included in your reports.

Deleted invoices – you can no longer take any actions with these invoices and your clients will not see deleted invoices. Data from these invoices will not be included in your reports.

You can reactivate archived or deleted invoices at any time.