Client’s VAT ID on invoices

There are countries where you are legally bound to add the client VAT ID (tax number) on the invoice if a certain amount is exceeded (e.g. Austria – for invoices over 8.000 € – or in case of a reverse charge notice).

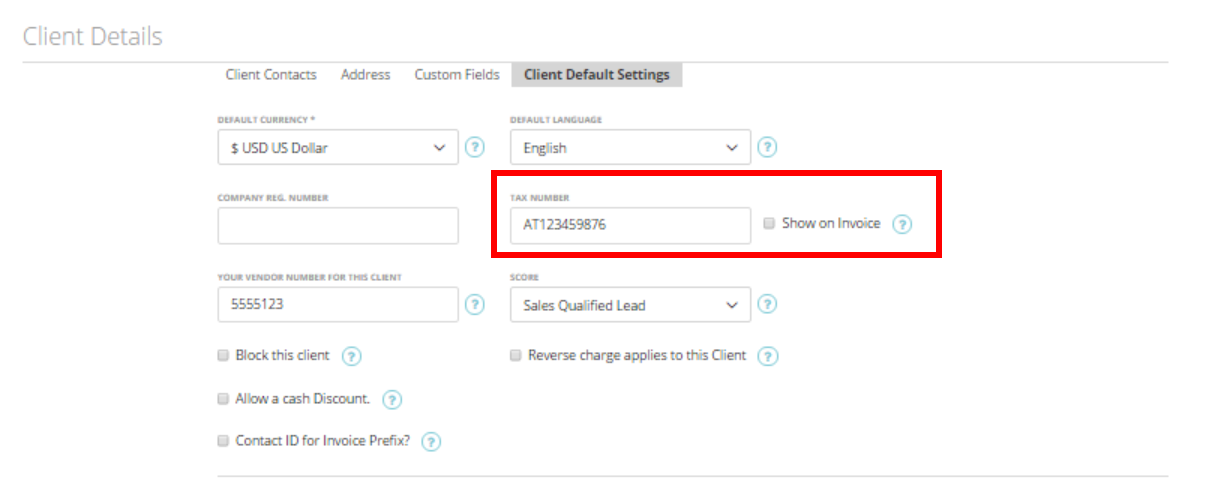

Go to ‘Contacts’ ➝ ‘Clients’, Select the client ➝ ‘Edit Client’. Under ‘Client details’, pick ‘Client Default Settings’ and enter the client’s VAT ID as shown in the example below:

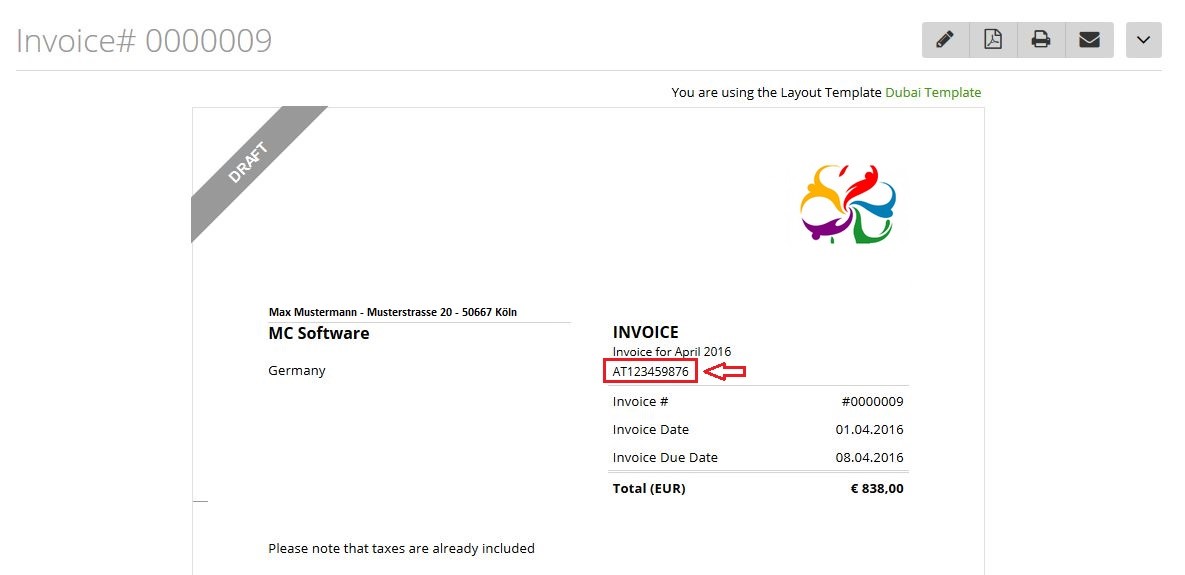

Once you tick the ‘Show on invoice’ box, we will automatically add it to the future invoices. Remember to save your edits by clicking ‘Save Client’ afterward. Here is a preview of how your client’s tax number will appear on the invoices:

Note: This option does work with all preset templates, if you create your own, please insert the placeholder “::client tax number::” whereever you prefer to show the VAT ID Info.