Where can I customize sales taxes?

What is Tax Group? How do I create it?

How will taxes be calculated for my products?

Taxes as a value, not percentage

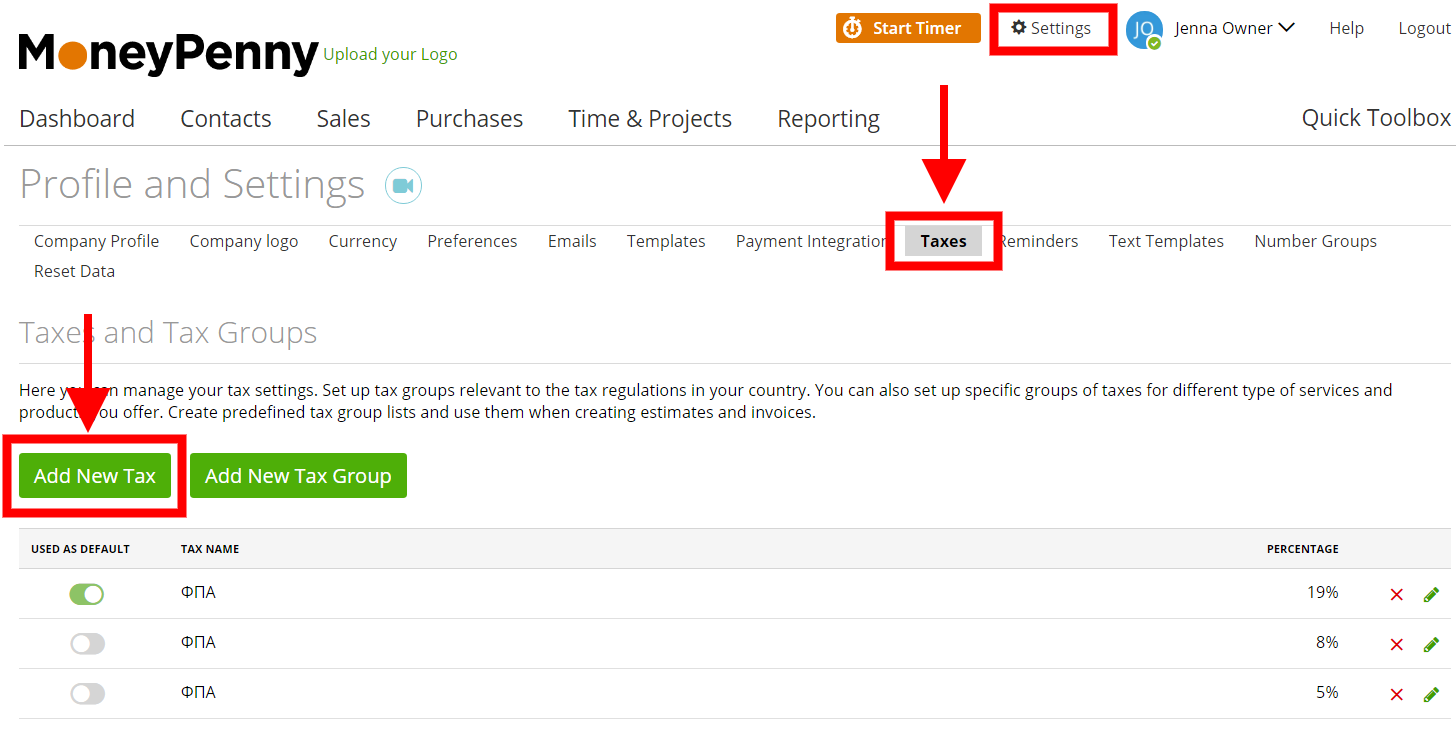

Where can I customize sales taxes?

To add new sales taxes, go to Settings ➝ Taxes ➝ Add New Tax

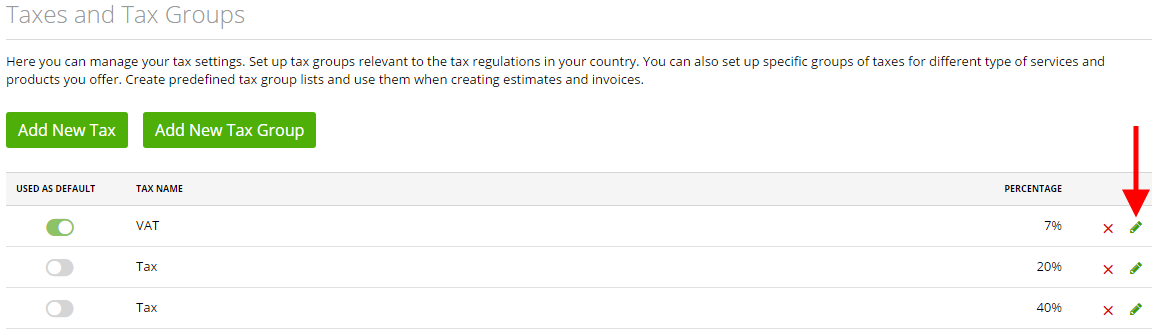

To update taxes go to, Settings ➝ Taxes ➝ click on the pencil icon on the grid

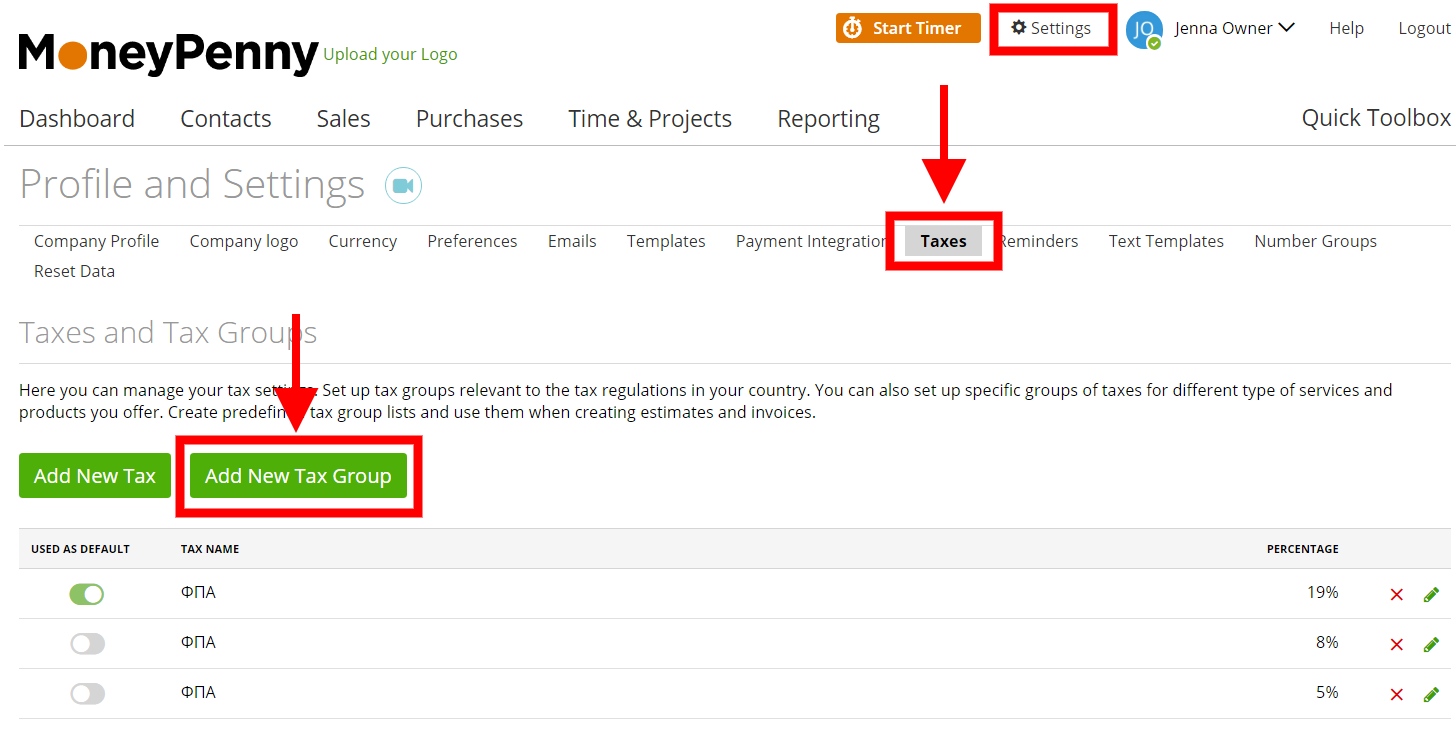

What is Tax Group? How do I create it?

You can create a Tax Group if you use more then one sales tax for your products.

To create Tax Group go to, Settings ➝ Taxes ➝ Add New Tax Group

Note: When you create a new product or task you will be able to assign a tax group for it.

How will taxes be calculated for my products?

Your taxes are customized as a percentage.

The amount of tax will be calculated based on a product’s or task’s cost.

Product and tax costs will initially exclude tax and If the tax needs to be applied, it will be calculated and presented on your estimate and invoice.

Tax as a value, not percentage

Sometimes you need to use taxes as a value. To be able to do that, you need to create an Invoice Template first: go to Settings -> Stationary Templates, more details here.

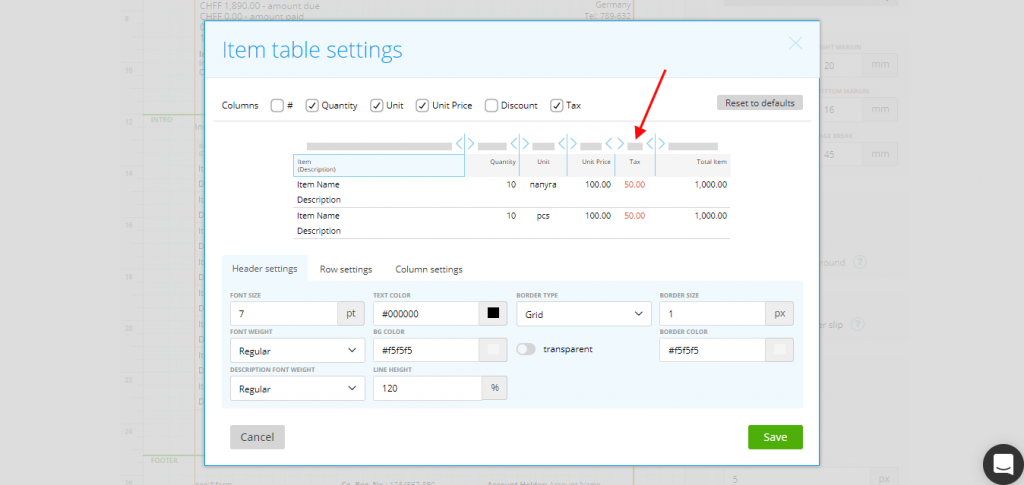

In the Item Tables once you click on the Tax column:

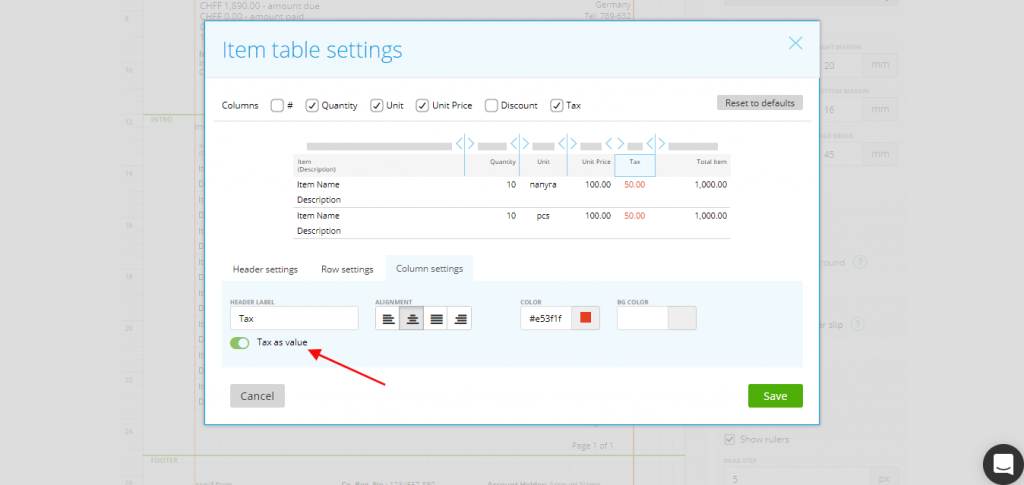

You will see the button pop-up, make sure it’s on:

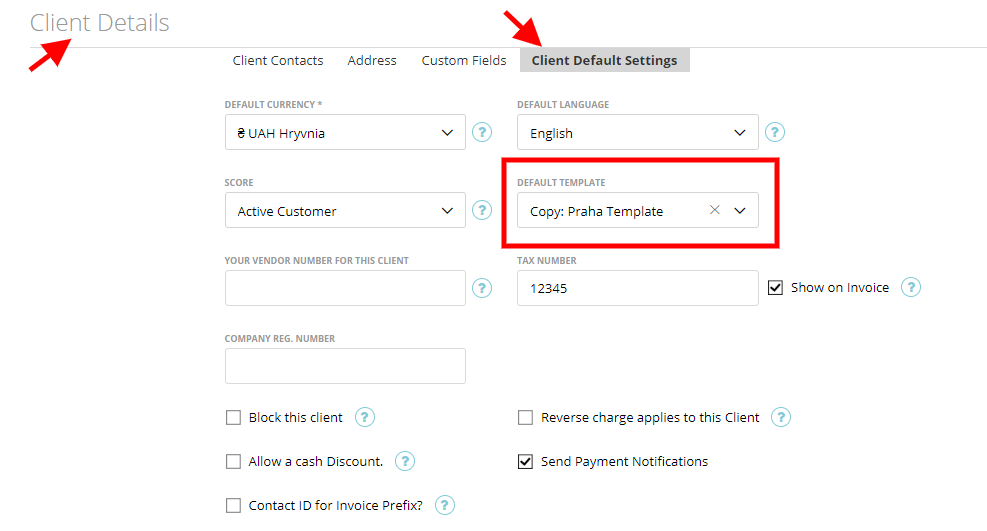

Don’t forget to hit Save when done with the Item Tables Settings, save the new template and also save this template as default:

You can also choose this template as a default one for your client:

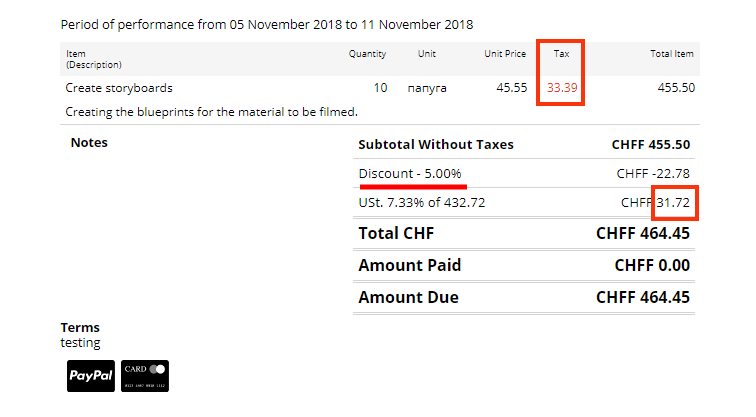

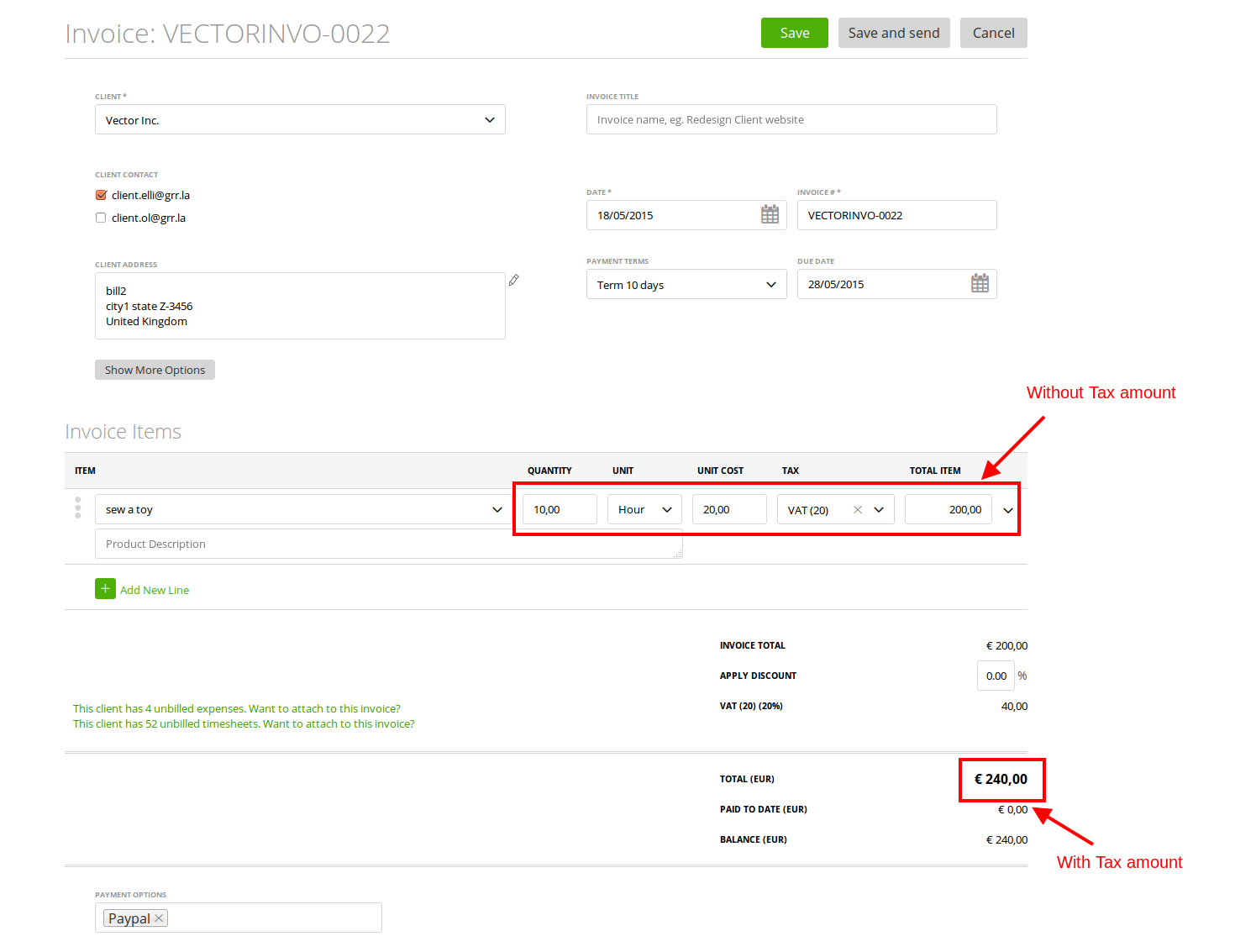

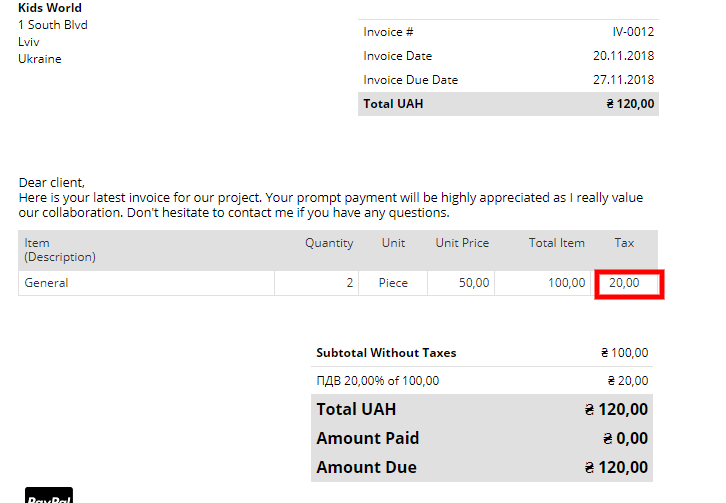

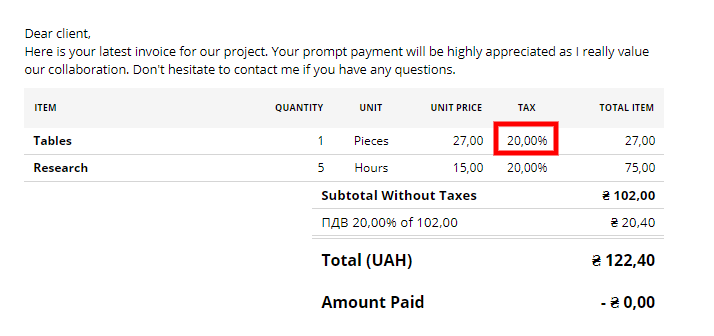

Now on the Invoices, you will see the tax as a value:

And not as a percentage as it was before:

Once creating an Invoice, please make sure you are using the correct template in the preview.

Note: If there was a discount on the invoice, we show the tax amount without the discount on the line item and the final tax amount in the total, after the discount was applied: