From 1 January 2024, the following current VAT rates apply in Switzerland:

Normal rate: 8,1 %

Reduced rate: 2,6 %

Special rate for accommodation: 3,8 %

Reason for the increase in tax rates: In the vote of 25 September 2022, the amendment to the AHV Act and the federal decree on the supplementary financing of the AHV were accepted.

What to do on zistemo?

Set new default tax

On Settings/Taxes create a new tax for the new VAT rates. After creating it, mark it as a new default tax. Here’s more about how to change the default tax ➜

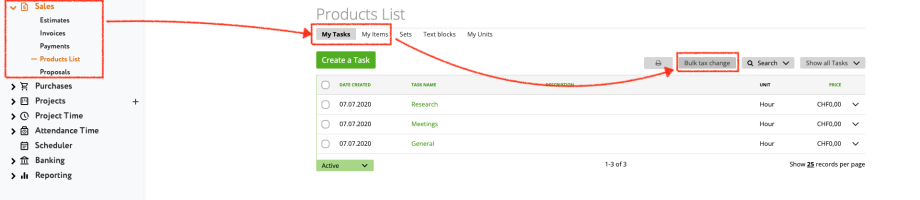

Bulk change tax rates

On you product list (sales/product list) you can change a tax rate as bulk-action. Please use the bulk tax change for tasks and items.

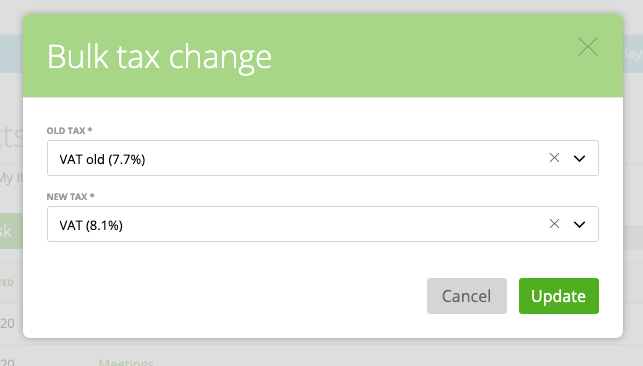

When using bulk tax change you need to select the current tax rate and the new tax rate that overwrites the old one for every task/item using that rate.

Please note that this action also changes the tax rate for all project tasks that were not created from a template. So, you don’t need to manually change tax rates for project tasks.

Recurring invoices

Please update the tax rate for your the invoice items on recurring invoices manually.