Depreciations

Depreciations Report

Depreciations

For some types of expenses, you can apply a depreciation. These expenses categories could be any of the following:

Office Equipment, Small Equipment, Software, Hardware, Other Office Equipment, Cars, and other Vehicles, Car Purchase, Other Vehicle Purchase, Properties, Plants and Equipment, Land, Buildings, Equipment, Machinery, Deposits, Intangibles, Investments, Patents and Rights, Inventory Purchase, Raw Materials.

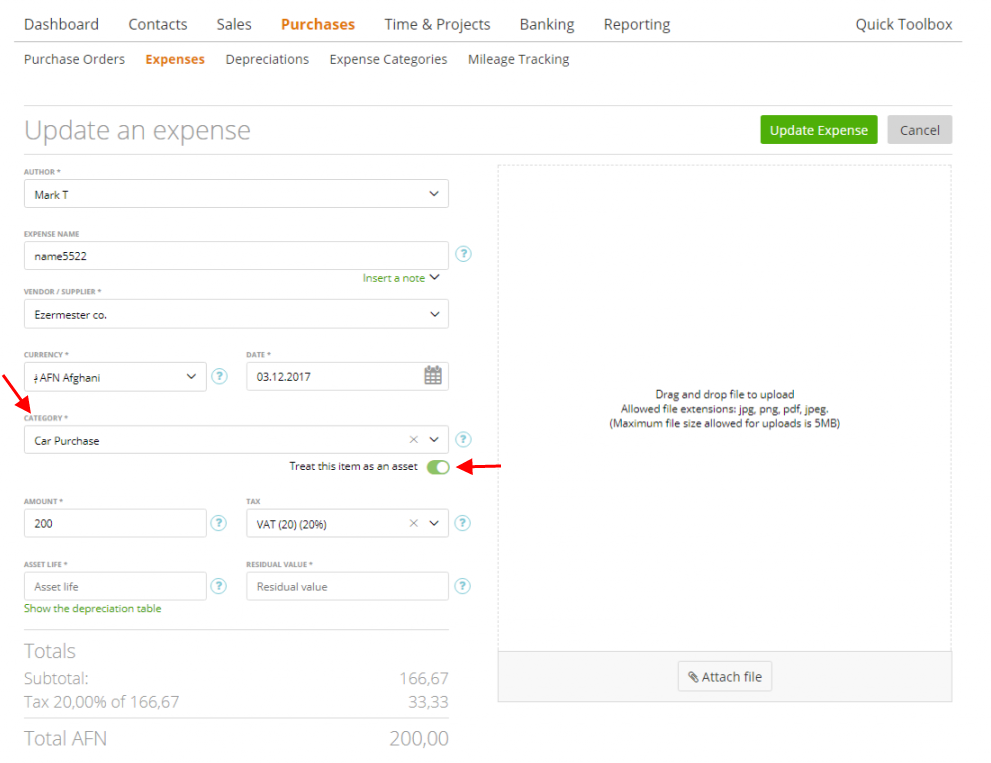

Therefore, on the Expense page, choose one of these categories and switch on the ‘Treat this item as an asset’ button as it’s shown below:

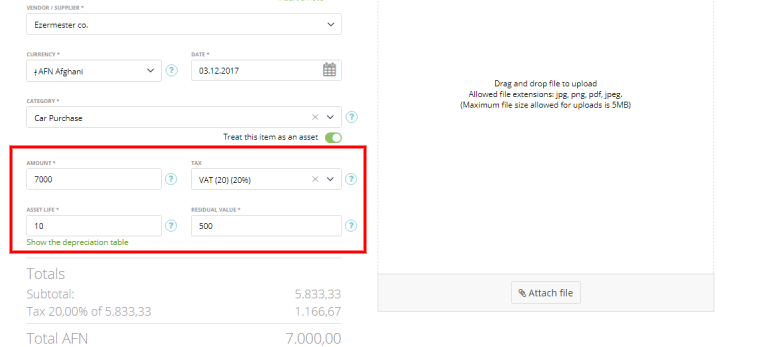

Then enter the amount, tax, the asset’s useful life, and its residual value:

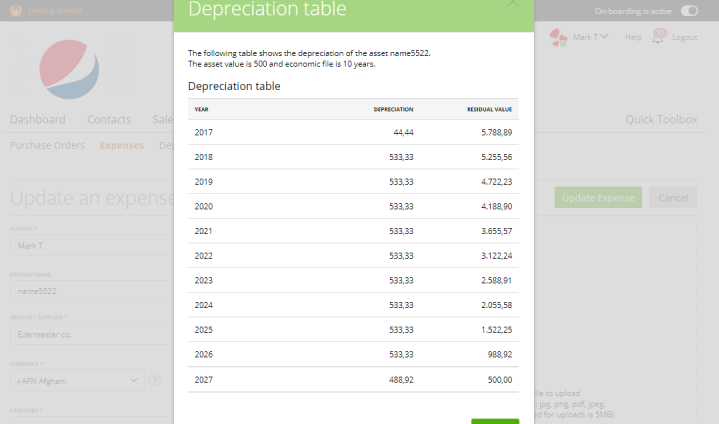

Click on the ‘Show the depreciation table’ link to see the depreciation calculation based on the entered data:

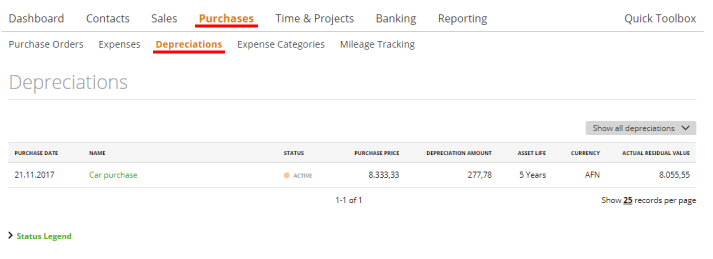

Once you save this expense, you will see its depreciation entries in the depreciation table (Purchases -> Depreciations).

This is where you can track the value of this asset.

Each month, the depreciation value will increase according to the Depreciation table so, at the end of the asset’s life, its value will be equal to the residual value.

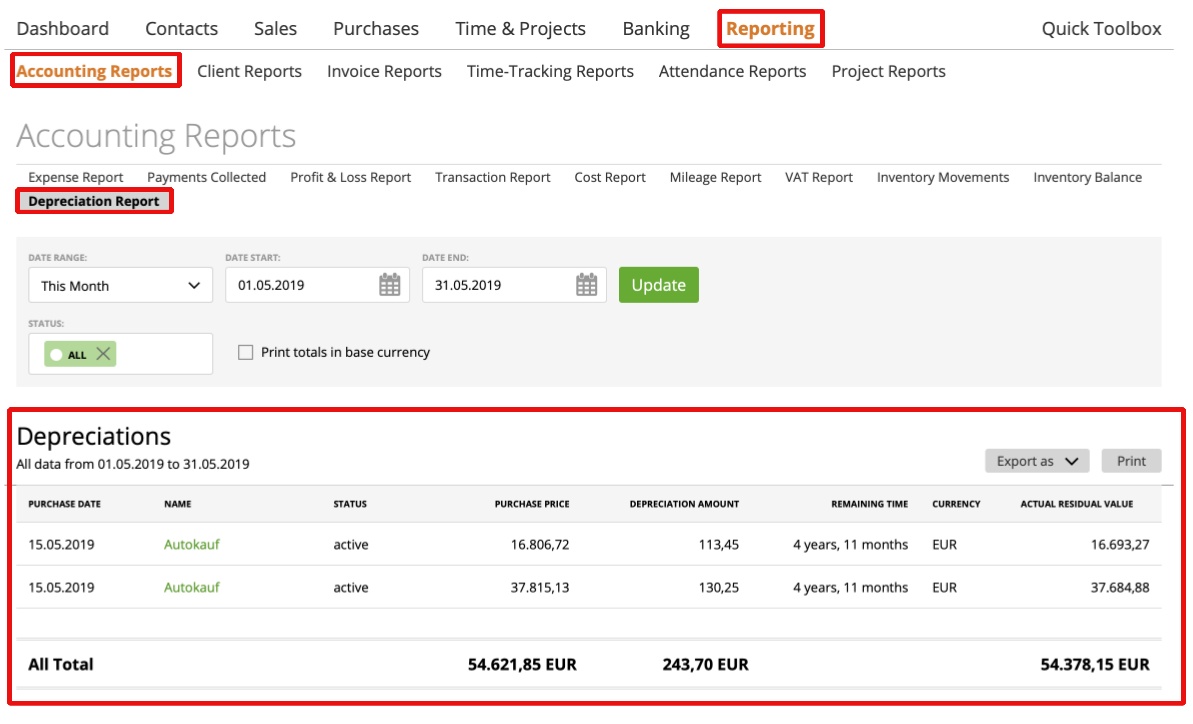

Depreciations Report

In zistemo reports you can also view your depreciations report and have the total overview.

You can set you date range, the start or end date also. Also you can filter after the current “status”

You also also export as PDF, CSV, EXCEL or jsut print it directly.

Please note that on the date filter, you select the date of the purchase itself, not the depreciation.