In order to create an expense in zistemo, you have two options:

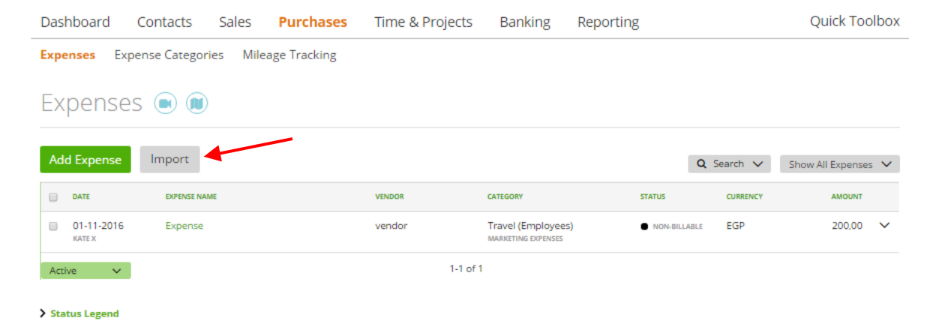

1. You can do it manually, by clicking the “Add Expense” button or

2. By import through .csv file (click the “Import” button -> choose ‘Import as CSV’ OR open user menu -> ‘Import’ -> choose ‘Import Expenses’ and click ‘Import’).

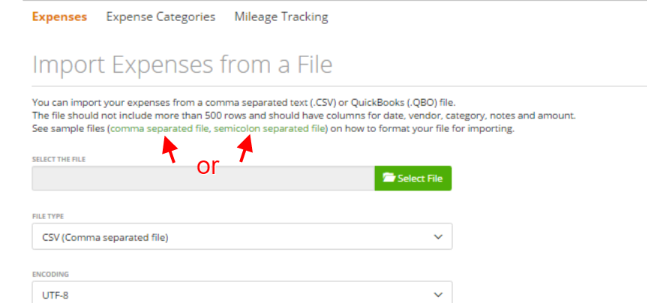

Note: Please use “UFT-8” for encoding

Next, you can download a sample file to see how this .csv would look. You can also view and download a sample file HERE.

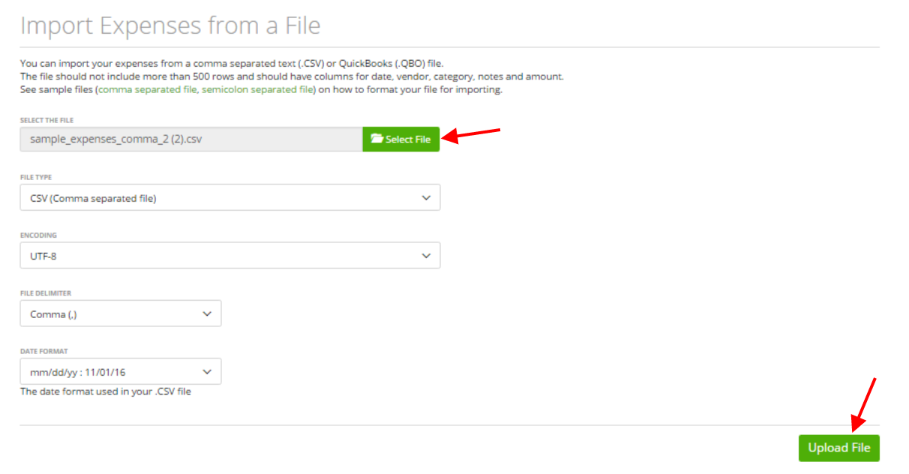

To create a .csv, select your file and click “Upload File”:

Importing Expense Categories

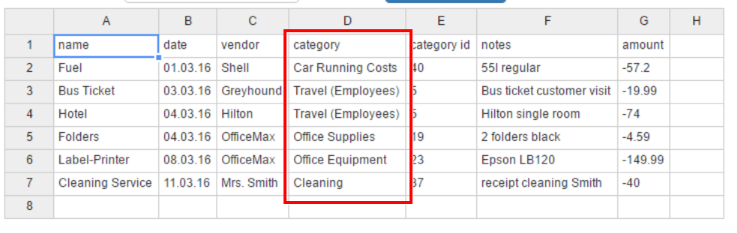

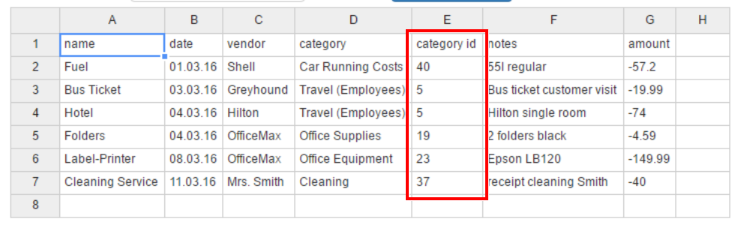

When importing your expenses, one of the required fields in your .csv file is “Category” (expense category):

If you use one of the existing categories, the system will take it from the existing list (find “Expense Categories” list in “Purchases” -> “Expense Categories”). If you use a category that’s not on the list, this new category will be added automatically to the “Expense Categories” list.

IMPORTANT: if you use the existing categories, remember to also fill the “Category ID” column to prevent mistakes. By the way, if you did not enter the correct ID (check out the list below to see the default IDs used in zistemo), the system will use the category with the ID you provided, which will override the existing (default) one.

Example: In zistemo, Advertising Cost ID is 1 and Representation Cost ID is 3.

If you enter “Advertising Cost” in the “Categories” column, but in the “ID” column you insert “3”, then this imported expense will be related to the category “Representation Cost”.

zistemo “Default Categories” and IDs

| ID | Name |

| 2 | Advertising Cost |

| 3 | Representation Cost |

| 4 | Food and Meals |

| 5 | Travel (Employees) |

| 6 | Travel (Owner) |

| 8 | Gifts and Giveaways |

| 9 | Sales Provisions and Commissions |

| 10 | Shipping, Transport, and Logistics |

| 11 | Packaging |

| 12 | Transport Insurance |

| 14 | Consulting Services |

| 15 | Research Services |

| 16 | Creative Services |

| 17 | Other Business Services |

| 19 | Office Supplies |

| 20 | Postage |

| 21 | Phone & Communication |

| 22 | Internet |

| 23 | Office Equipment |

| 24 | Books and Magazines |

| 25 | Training and Education |

| 26 | Small Equipment |

| 27 | Software |

| 28 | Hardware |

| 29 | Other Office Equipment |

| 31 | Rent |

| 32 | Heating and Ventilation |

| 33 | Gas |

| 34 | Electricity |

| 35 | Water |

| 36 | Trash |

| 37 | Cleaning |

| 38 | Maintenance |

| 40 | Car Running Costs |

| 41 | Car Insurance |

| 42 | Car Rental |

| 43 | Car Taxes |

| 44 | Car Purchase |

| 45 | Other Vehicle Purchase |

| 47 | Land |

| 48 | Buildings |

| 49 | Equipment |

| 50 | Machinery |

| 51 | Deposits |

| 53 | Investments |

| 54 | Patents and Rights |

| 56 | Finishing Goods |

| 57 | Raw Materials |

| 58 | Subcontracting |

| 60 | Insurance Premium |

| 61 | Membership Fees |

| 62 | License Fees |

| 64 | Legal Fees |

| 65 | Annual Report and Tax Fees |

| 66 | Bookkeeping Costs |

| 68 | Financial Fees |

| 69 | Interest Paid |

| 70 | Interest Received |

| 71 | Financial Adjustments |

| 72 | Owner Payment |

| 73 | Owner Withdrawal |

| 75 | Employee Salary |

| 76 | Employee Salary Tax |

| 77 | Temporary Employee Salary |

| 78 | Temporary Employee Salary Tax |

| 79 | Social Security |

| 80 | Medical Expenses and Sick Leave |

| 81 | Unemployment Cost |

| 82 | Non-Monetary Salary |

| 83 | Transport Costs from / to Work |

| 85 | Income Tax |

| 86 | Company Tax |

| 87 | VAT Payment |

| 88 | VAT Refund |

| 89 | Import VAT |

| 91 | Local Income Tax |

| 92 | Employer Social Security Costs |